After a quarter with all-time record-high prices for all weight classes of cattle and the annual Cattle Inventory report confirming that liquidation continued in all classes of females, our market outlook holds unchanged. We had expected price volatility, but it is likely to be more of a market factor going forward given uncertainties around cattle imports and exports; consumer frustration from the cumulative effect of food price inflation; and a forecast of escalating drought.

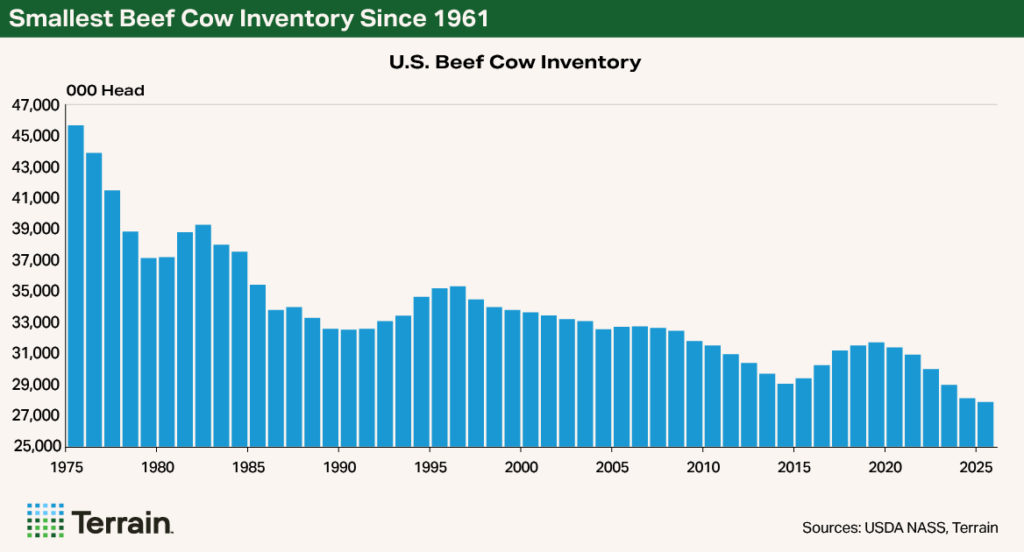

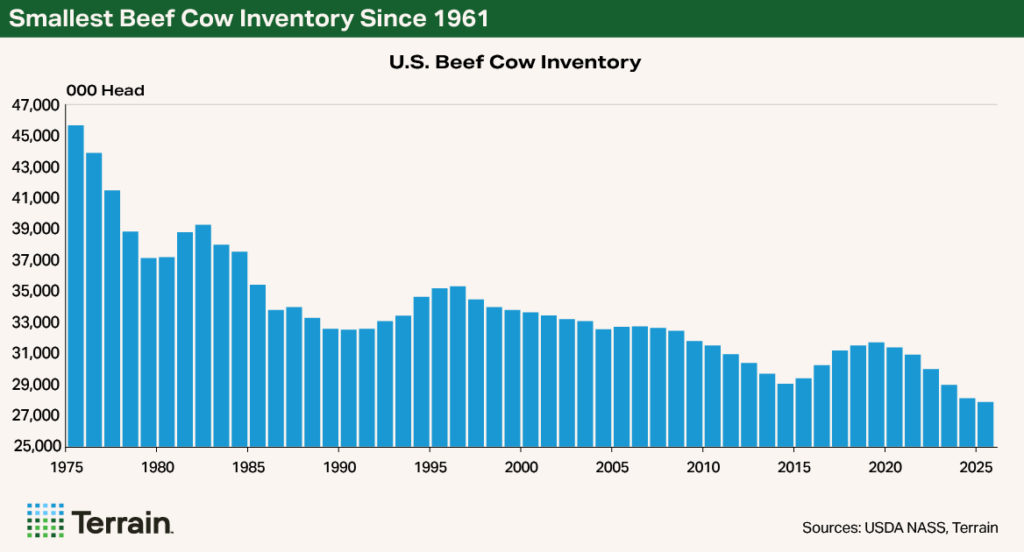

The Cattle Inventory report’s big takeaways were that the cattle herd is smaller by all accounts, breeding herd liquidation continued, and widespread herd rebuilding hasn’t begun. Additional slight declines in females and total cattle numbers are anticipated in 2025.

- The estimated all cattle and calves number sits at 86.7 million head, with all the report’s major categories showing a 1% decline.

- U.S. beef cows totaled 27.9 million head and are at their lowest since 1961.

- All the beef heifer measurements of “kept for breeding” and “other heifers” were down 1%, while the number of heifers expected to calve during 2025 was down about 2%.

- Heifers made up 38.7% of cattle on feed as of January 1, still well above the 36% to 37% neutral levels, confirming that there is not yet an adequate supply of retained beef heifers to indicate that herd rebuilding has begun.

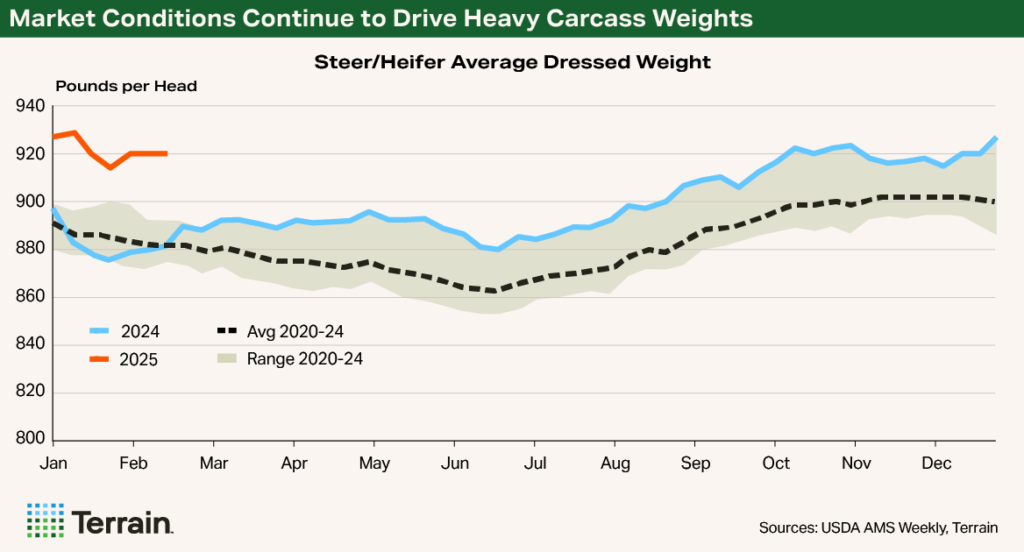

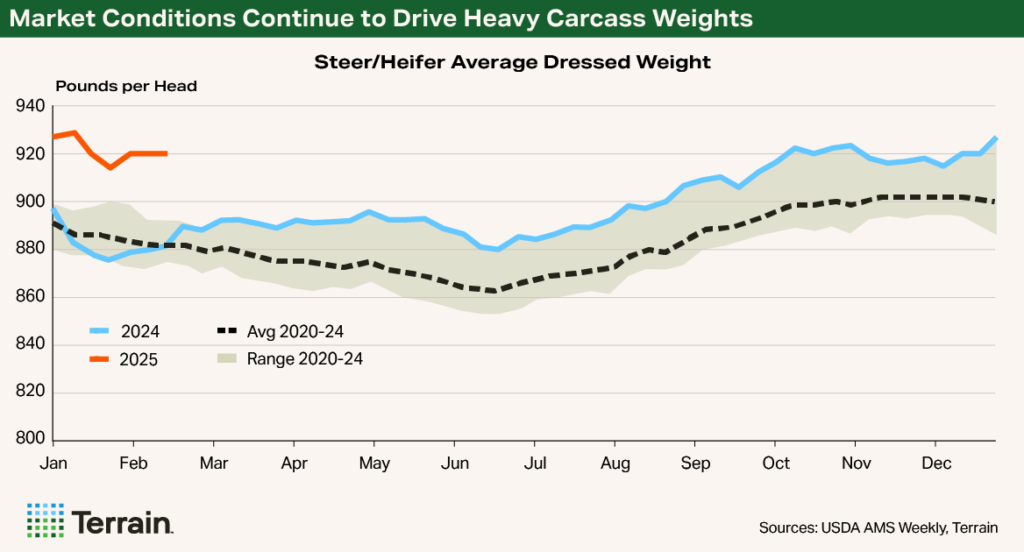

Packers are allowing carcass weights up to 1,150 pounds with no discount to compensate for the reduction in slaughter.

For the year to date, federally inspected slaughter head count is down 3% from year-ago levels and is expected to continue to decline as supplies of replacement cattle tighten. Beef production is fractionally higher than a year ago. The offset is driven by cattle being held on feed additional days because of an exceptionally favorable ratio of value of gain over cost of gain.

Packers are allowing carcass weights up to 1,150 pounds with no discount to compensate for the reduction in slaughter. Carcass weights are currently averaging 40 pounds heavier than a year ago. While they are likely to remain extremely heavy on a historical basis, we expect the increase over a year ago to narrow as the year unfolds — partly because of the rate of weight increase throughout 2024, and partly because cattle feeders will be hard-pressed to make cattle heavier than current levels without running into escalating discounts on Yield Grades 4 and 5.

We expect fed cattle prices to return to the $210/cwt level during the peak of grilling season.

Fed cattle prices surged in January to record prices of $210/cwt to $212/cwt. Although the market has dipped below the $200/cwt price level, we expect fed cattle prices to return to the $210/cwt level during the peak of grilling season. From there, we expect a correction to $190/cwt to $195/cwt, followed by another round of record prices up to $220/cwt by the fourth quarter.

Feeder cattle prices should see seasonal pressure into March through May, as offerings are expected to increase due to seasonal movement of cattle off winter grazing programs to market. From a spring low to summer high, we are expecting late-summer and early-fall feeder cattle prices to trade in the $295/cwt to $305/cwt range.

Beef demand continues to be exceptional.

Calf prices have been exceptionally strong. Besides general tight supplies, demand for summer grazing cattle has been supporting the market. Imports of cattle from Mexico have resumed following the border’s closure due to the discovery of New World screwworm in November, but shipments have been very slow, helping to maintain price levels. I expect calf prices to ease during the summer before returning to the $400/cwt-plus level in the fourth quarter.

Beef demand continues to be exceptional. The combination of beef clearance and retail prices don’t suggest demand is starting to slow. Given the current demand and our expectation of tightening beef supplies, retail beef prices of all categories will likely increase. While there is no evidence of slowing demand yet, tightening consumer budgets could pressure the market.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.