Quarterly Outlook • October 3, 2025

Big Supplies, Slowing Demand Roil Sugar Prices, Margins

Report Snapshot

Situation

Even though planted acres are at the lowest level in more than four decades, yield increases combined with declining consumption point to ample supplies in the near term. Stocks-to-use in the U.S. remains elevated and well above the 13.5% targeted in the U.S.-Mexico suspension agreement.

Finding

In the U.S., sugar consumption is projected to be at a 10-year low, and when combined with large supplies I expect prices paid to growers will decline in 2025, optimistically in the mid $50s per ton.

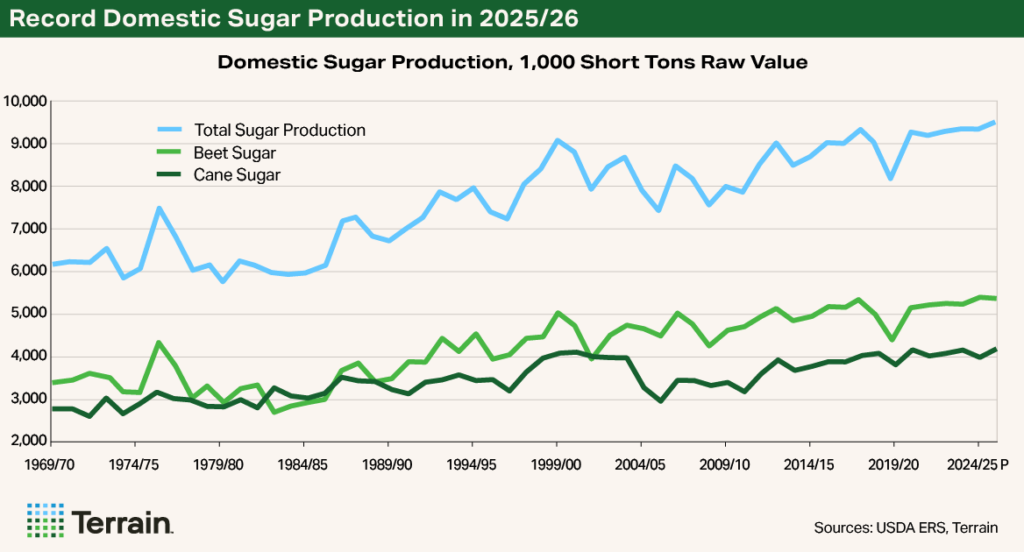

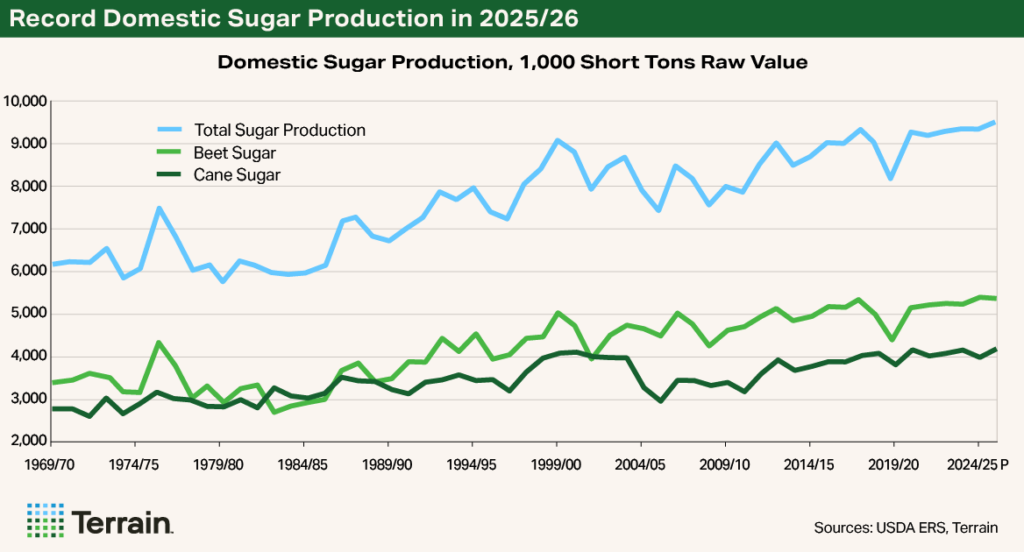

Big Sugar Supplies Loom

Following the decommissioning of the last sugar beet factory in California, and the subsequent decline in planted area, U.S. sugar beet farmers are projected to have planted the fewest acres in more than four decades at 1.079 million acres. Given a near-record yield of 33 tons per acre, 2025/26 U.S. sugar beet production is now estimated at 35.3 million short tons — the sixth-highest all time. Of the top three sugar beet-producing states:

- Minnesota production is projected to be 8% higher than last year at 12.8 million short tons

- North Dakota production is mostly flat year-over-year at 6.6 million short tons

- Michigan production is projected to be 12% higher at 4.6 million short tons

For the 2025/26 crop currently being harvested, beet sugar production is estimated at 5.3 million short tons raw value (STRV) and the second-highest all time (following 2024/25’s record production). When combined with estimated cane sugar production of 4.167 million STRV, domestic sugar production for 2025/26 is projected at a record 9.47 million STRV. Combined with beginning stocks of 2.436 million STRV, and sharply lower projected imports of 2.235 million STRV, the U.S. sugar supply stands at slightly more than 14.141 million STRV, down 4% from 2024/25.

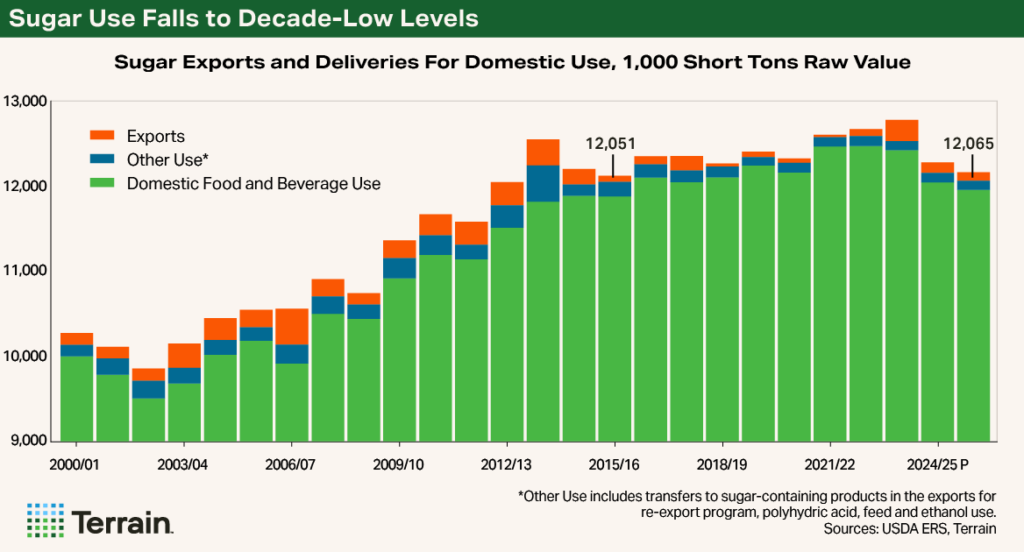

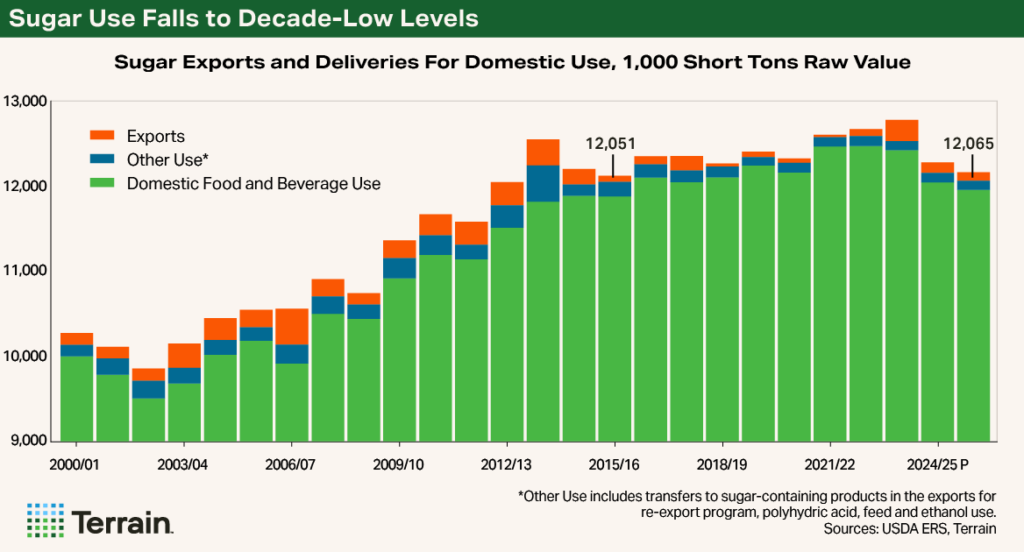

Sugar Use Falls to 10-Year Low

Record sugar production is not coming at an opportune time. For the upcoming 2025/26 crop year, sugar use for domestic food and beverages is projected at 11.96 STRV, down 1% from last year and the third consecutive year of declining sugar consumption. When including other sugar uses such as direct sugar exports or the use in sugar-containing products for exports under the re-export program, total sugar use in 2025/26 is projected at 12.165 STRV, again down 1% from last year and the third straight year of lower total sugar use. If realized, total sugar use in 2025/26 would be the lowest since 2015’s 12.091 STRV use level.

There are many factors contributing to lower use, including high retail food inflation over the past several years as well as inventory adjustments and potential dietary changes.

Driven by a sharp decline in projected imports, sugar ending stocks for 2025/26 are currently projected at 1.976 STRV, down nearly 19% and the lowest since 2022/23. When combined with estimates of total use, however, the sugar stocks-to-use level remains elevated at 16.2% and higher than the 13.5% goal established in the U.S.-Mexico sugar suspension agreement.

Tight Margins for Sugar Beets

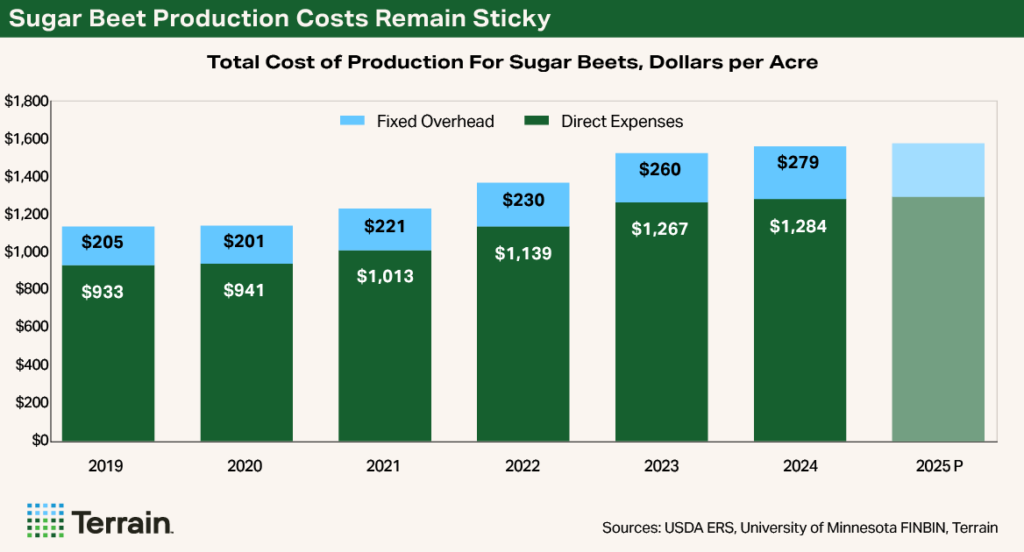

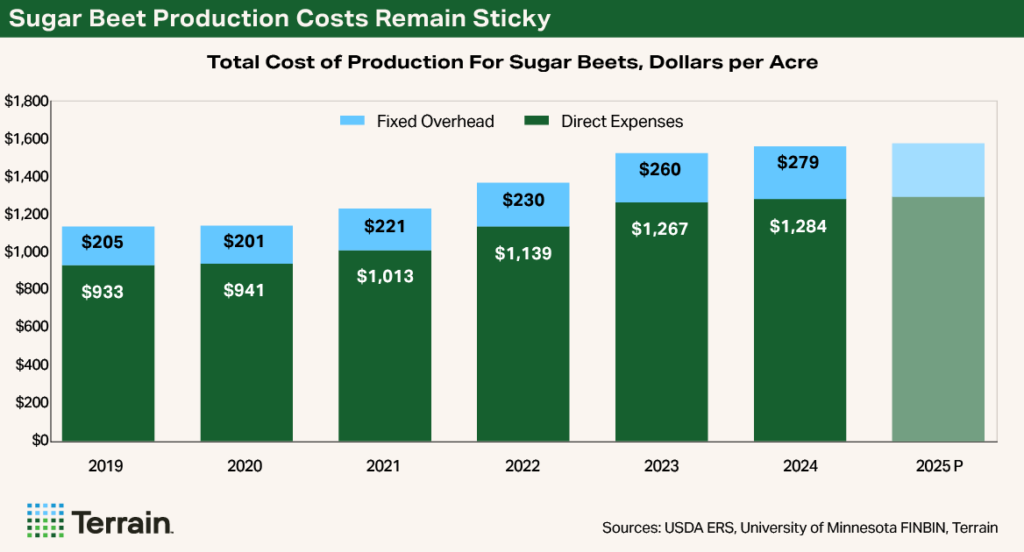

Like other major field crops, input costs on the farm have increased dramatically in recent years. According to the University of Minnesota’s FINBIN direct expenses for sugar beet production, e.g., seed, fertilizers, crop protection tools, and land rents among others, reached a record-high of $1,284 per acre in 2024. Similarly, overhead expenses such as machinery and building leases or hired labor rose to a record of $279 per acre in 2024. Combined, the total costs of sugar beet production in 2024 were estimated by FINBIN at $1,563 per acre. (Note: The FINBIN sample does not include sugar beet production in many other states including about 50% of U.S. sugar beet production.)*

My expectation, given that USDA’s Economic Research Service projected input costs for major crops such as corn, soybeans, wheat and cotton, to rise by an average of 1% from 2024 to 2025, is that the cost of growing sugar beets (including direct and overhead expenses) likely rose to a new record in 2025 — approaching $1,600 per acre based on FINBIN-sampled farms. Compared to the pre-inflation environment of 2020, sugar beet direct expenses are up nearly 40% or more than $400 per acre. This does not bode well given the current price environment for growers.

With record supplies and slowing sugar utilization, U.S. sugar prices have been under pressure this year. According to the USDA’s Economic Research Service Sugar and Sweeteners Yearbook Tables, for August 2025, the spot price for bulk refined beet sugar fell to 35.75 cents per pound and the price for bulk refined cane sugar fell to 52 cents per pound — down significantly from year-ago levels.

These lower sugar prices are most certain to make their way into the net payments received per ton. According to the University of Minnesota’s FINBIN the average price received in 2024 in the FINBIN region was approximately $73 per ton — down from 2023’s record of nearly $81 per ton. Given input cost (including overhead and direct expenses) and yield projections, I estimate that sugar beet prices in the FINBIN region would need to be in the mid $50s per ton for margins to approach breakeven. Other regions will have different breakeven prices for sugar beets based on regional costs of production. Anecdotally I am hearing of potential prices paid to growers in the Red River Valley region in the mid $50s per ton — emphasizing the tight margin environment many sugar beet growers are facing today.

*The geographic region captured in FINBIN data includes Illinois, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, Pennsylvania, South Carolina, Utah and Wisconsin. Not all states have sugar beet data reported to FINBIN.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.