Report Snapshot

Situation:

Lower prices for competing pork and poultry products aren’t able to put a dent in beef consumption.

Finding:

Trade disruptions and tariff negotiations are leaving some extra beef in our tight domestic market, offsetting price impacts each factor would have.

Outlook:

Results of tariff renegotiations and gaining geo-political tensions in the Mid East remain the greatest market risks.

Consumers Have a Taste for Beef

Whether it’s steaks for dinner, a roast for Easter or grilled burgers on a warm spring day, consumers have put plenty of beef on their plates so far in 2025.

Real per capita consumer expenditures (RPCE) for beef is how I measure how much Americans spend per person over time. During April 2025, at $35.47 of spending per person (deflated to 2014 dollar values), RPCE increased 9% year-over-year (YOY) versus 2024 and were up 7.7% year-to-date (YTD) versus a year earlier. Likewise, beef demand has been up more than 7% on an index basis since the beginning of 2025 and was up nearly 8% during April 2025 compared to a year ago.

Beef demand has posted only one YOY decline during 2025 and that was in February (-3.5%), which was followed by a strong rebound during March 2025 with 17.3% YOY growth.

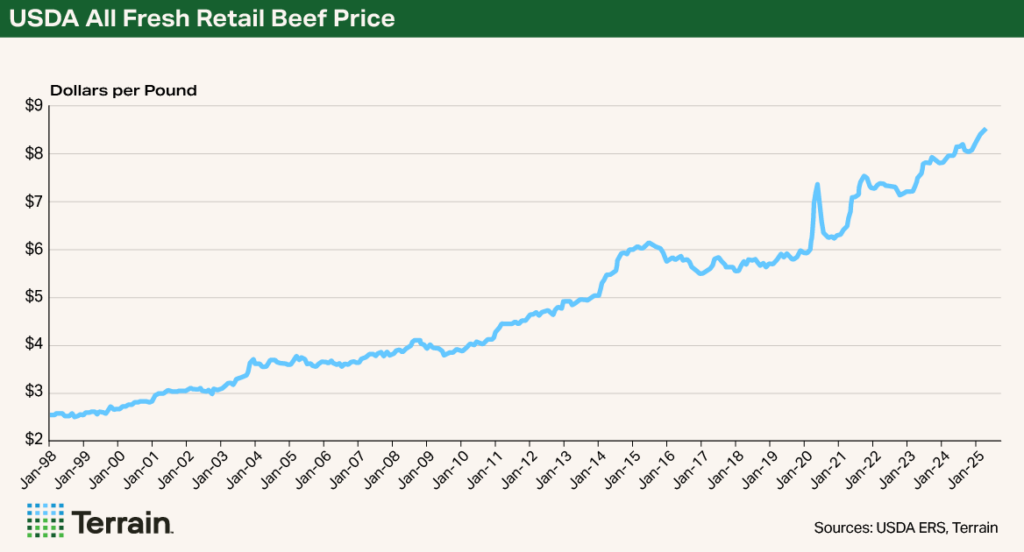

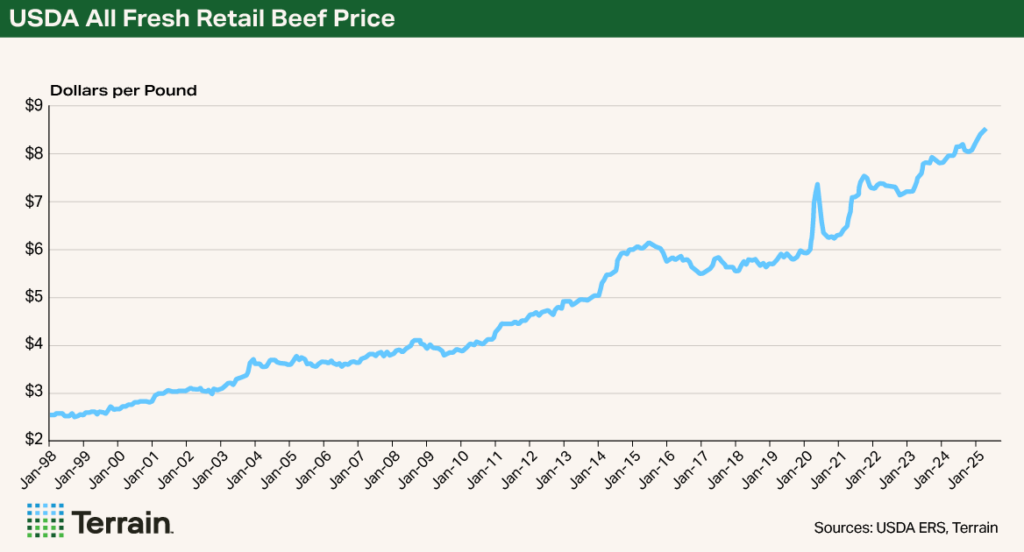

The story of continued weak demand for competing pork and poultry products compared to beef continues with YTD RPCE for pork and poultry down 0.3% and 0.2%, respectively. The USDA all fresh retail beef price was a record high at $8.50/lb. during April 2025 and has posted 23 consecutive months of YOY gains.

In the current environment of strong wage and job growth, taming inflationary pressures, and tight beef supplies, lower prices for poultry and pork have not had much effect on beef prices or spending.

Seasonal shifts in supplies, retail grocery featuring activity and trade flows could still lead to volatility in prices for the balance of 2025. But continued strong beef demand is a critical factor for beef and cattle prices to continue their current rally.

No Sign of Herd Rebuilding

The number of feeder cattle and calves outside of feedlots began the year about 0.5% smaller than a year earlier at 24.557 million head. If heifer retention were happening in a meaningful way to rebuild the cow herd, that decline would have been larger.

Beef cow slaughter through Q3 2025 was down about 15% from year earlier levels, and I expect the beef cow slaughter pace to stay near these levels of decline into the fourth quarter. The reduction in beef cow slaughter numbers has been nearly 3% larger than I forecast at the beginning of the year and has been big enough to stabilize beef cow numbers.

My current forecast projects beef cow inventories to be 0.5% to 0.7% larger on January 1, 2026, than they were at the start of 2025, if the reduction in beef cow slaughter continues.

I don’t consider this to be a large enough change to classify the current trend as active herd rebuilding since the industry hasn’t started retaining and breeding more heifers. Long term, the industry can’t grow by reducing cow slaughter only. We must add heifers into the herd for any lasting effect.

The reduction in beef cow slaughter … has been big enough to stabilize beef cow numbers.

New World Screwworm Remains a Risk

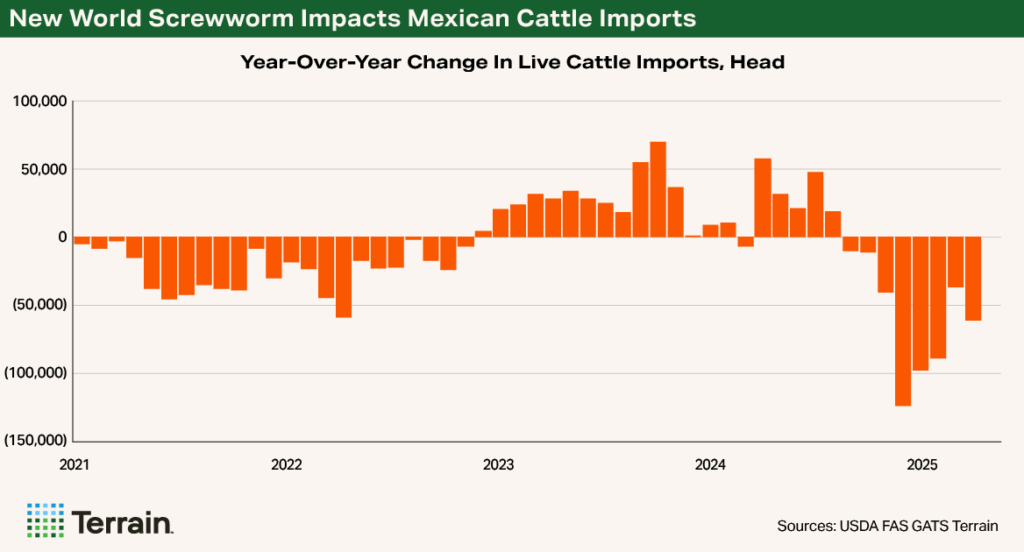

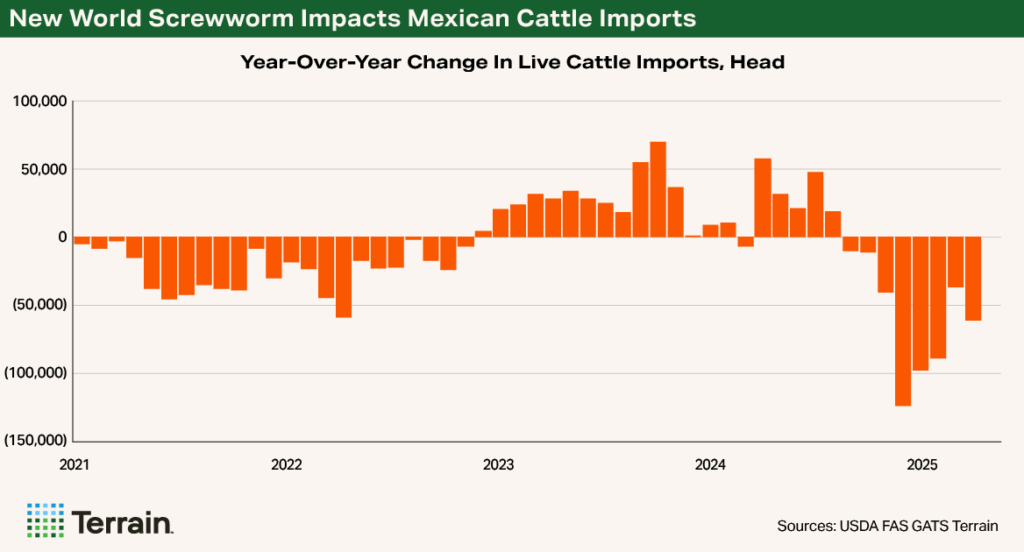

The re-closure of the U.S.-Mexico border to cattle and other livestock imports from Mexico remains in effect. USDA officials have indicated that they will re-determine the border status at least monthly and conduct constant evaluations of the northern spread of New World Screwworm from the Yucatan into central Mexico. Many analysts, including me, believe the border is likely to remain closed for at least the balance of 2025, and potentially longer if a case is discovered in the U.S.

I expect the net result will be about 750,000 to 800,000 fewer feeder cattle and calves imported into the U.S.

I expect the net result will be about 750,000 to 800,000 fewer feeder cattle and calves imported into the U.S. Fewer imported cattle combined with the decline in feeder cattle and calf supplies suggests that placements for the year could decline 900,000 to 1 million head. That amounts to 4.5% fewer feeder cattle and calves for the year versus the 0.5% decline that USDA expected at the beginning of the year.

Slaughter Slows Down

My forecast for fed cattle slaughter is a 5% to 7% decline at the beginning of Q3 and a more modest 4% to 6% decline for Q4 2025, bolstered by larger March through May placements of cattle into feed yards.

For context, the number of finished cattle for the summer (before accounting for carryover supplies from previous months) will be 5% smaller than the same June through August period last year and 7.5% smaller than the previous 5-year average.

Cash Prices Remain Robust

Record 5-area fed cattle prices and very large basis premiums to June and August live cattle futures are working to accelerate cattle marketings. This action will temporarily support show lists in the early summer, eventually cleaning up the carryover in June, and will turn into pulling cattle ahead in the late summer.

The early indicator for this transition will come in the form of fed cattle carcass weights declining faster than the normal seasonal trend or extending their decline beyond late June, though the large spread between cost-of-gain and value-of-gain and the record break-evens are likely to keep weights higher YOY.

Resulting beef production, compared to a year earlier, is projected down 2.3% to 2.6% during Q3 2025 and down 2.7% to 3.0% during Q4 2025.

The limiting factor of the scenario will be how negative packers allow margins to get and how long they will tolerate those low margins. The mid-June boxed beef cutout rally has narrowed packer losses and likely pushed this tipping point further back into the fall.

Price Outlook for the Summer

Wholesale beef and live cattle prices are expected to retreat off the record highs as purchasing for the Independence Day holiday wraps up and the market enters the proverbial “dog days of summer.”

I expect Q3 2025 5-area live cattle prices to settle in the mid-to-upper $230s and for the premium for northern cattle to continue. My forecast is for average summer feeder cattle prices to range from $290/cwt to $310/cwt.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.