Beef Demand: Envy of the Protein Markets

Article Originally Published in the August 2024 Issue of the National Cattlemen Magazine

By Dave Weaber, Senior Animal Protein Analyst

Beef demand so far in 2024 has been nothing short of amazing. This is despite talk in the livestock and meat industry that, at some point, consumers will run out of spending capacity and beef will be the first to suffer the consequences.

While this sentiment may eventually ring true, there is little evidence that consumers are trading down from beef to lower-priced pork and poultry items at the meat counter. Furthermore, comparisons of consumer spending levels by beef quality grade at the wholesale level show strong performance among all beef quality grades and branded beef as well as growth in the ungraded trimmings and ground beef category.

The consumer price index (CPI) data for June 2024 was welcome news as inflation slowed more than economists had expected, landing at 3% on an annualized basis. U.S. consumer prices declined from a month earlier for the first time in four years, dropping 0.1% from May. I am hopeful that this news can begin to bolster consumer confidence and confidence at the Federal Reserve that inflation is cooling after it surged in the first quarter.

We economists have worried for some time that growing credit card debt levels and substantially higher interest rates could put a damper on consumer spending, but continued growth in job rolls, wages and disposable income has increased consumers’ ability to service debt.

We have heard from retail grocery analysts that some consumers have had to make hard choices regarding spending, but so far they have chosen to trade down on center-store items to maintain spending in the “fresh” departments. Additionally, younger consumers are choosing high-quality food items for the experience and are shopping for smaller quantities. I believe this is benefiting the beef segment, as these are likely customers who are choosing to prepare their own high-quality steak or beef entrée at home for the same cost or less as ordering it at a restaurant.

Grocery stores continue to promote middle-meat steak items for summer grilling, and featured steak prices have been very aggressive in some markets. For example, the Denver market has seen multiple grocery store companies featuring Choice bone-in ribeyes, either whole or cut into steaks, at less than $6/lb. three times since Easter.

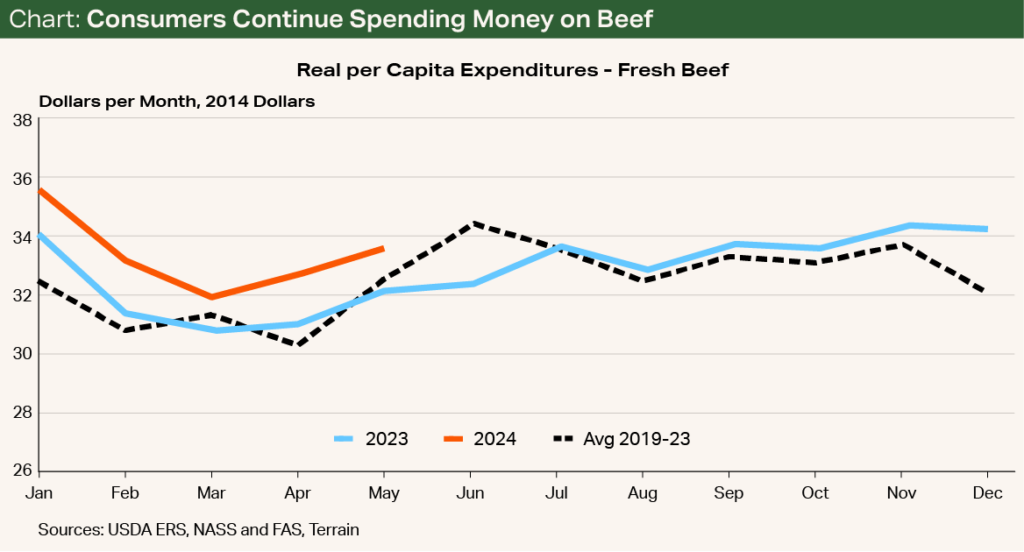

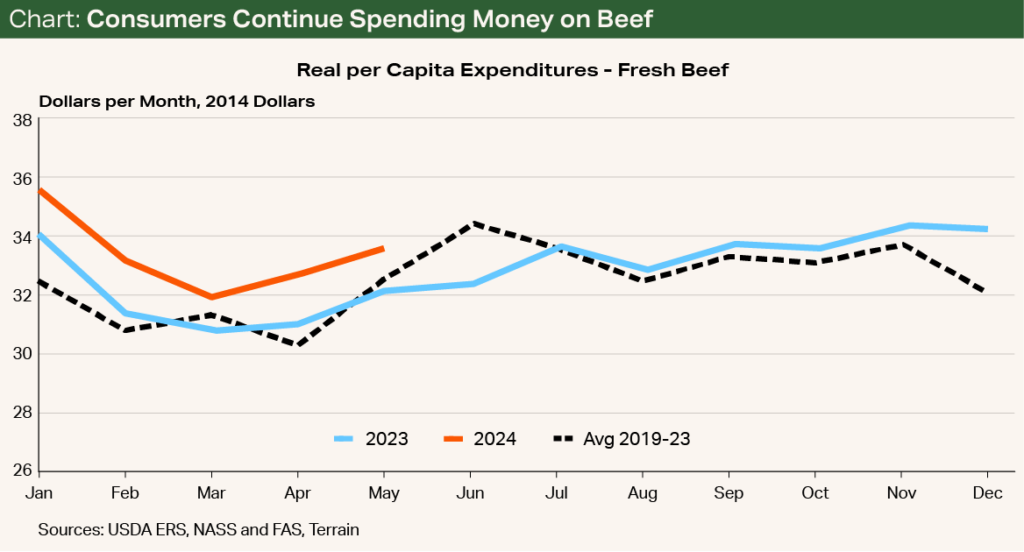

Aggressive featuring has kept beef top of mind for consumers and driven sales across the category. Our measurement of real per capita expenditures for fresh beef has shown positive gains for every month this year.

Through May 2024, year-to-date fresh beef real per capita expenditures, which includes ground beef, was up 4.8% versus a year earlier (see Chart). Conversely, pork was down 3.2% and chicken fell 3.1%. The fresh beef demand index from January through May 2024 was up 3.75% versus a year earlier while the pork index for the same period was down 2.57% and the chicken index declined 2.02%.

Maybe more telling of beef’s strong consumer preference is that fresh beef spending has accounted for more than 51% of the three species’ total real (inflation-adjusted) per capita expenditures so far in 2024, leaving the other species to split the remaining 49%. Growth in domestic per capita consumer spending on beef at the wholesale level, measured by using the comprehensive cutout, mirrors the fresh beef spending trend and was up the same 4.8% from January through May 2024 compared with a year earlier.

Strong 2024 nominal (not inflation-adjusted) consumer beef spending at both the retail and wholesale levels has been supportive to prices across the beef supply chain. While retail prices remain record high, wholesale cutout values across grades have the potential to set a record high for July. These spending levels resulted in recent record weekly prices in the live and feeder cattle futures, 5-area live cattle prices, and prices for many classes of feeder cattle and calves.

Seasonal factors led by the dog days of summer will likely suppress beef product movement as consumers cook indoors more in late summer. I expect the trend to limit (but not rule out) rally potential in the live cattle market until Labor Day or so. Continued tightening of feeder cattle and calf supplies will likely reduce placements of cattle into feedlots, further tightening fed cattle supplies in late Q3 and Q4 2024 — all supportive to prices for beef and all classes of cattle.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.