Quarterly Outlook • February 2023

Beef Cow Slaughter Continues into 2023 at Herd Liquidation Pace

Report Snapshot

Production Forecasts

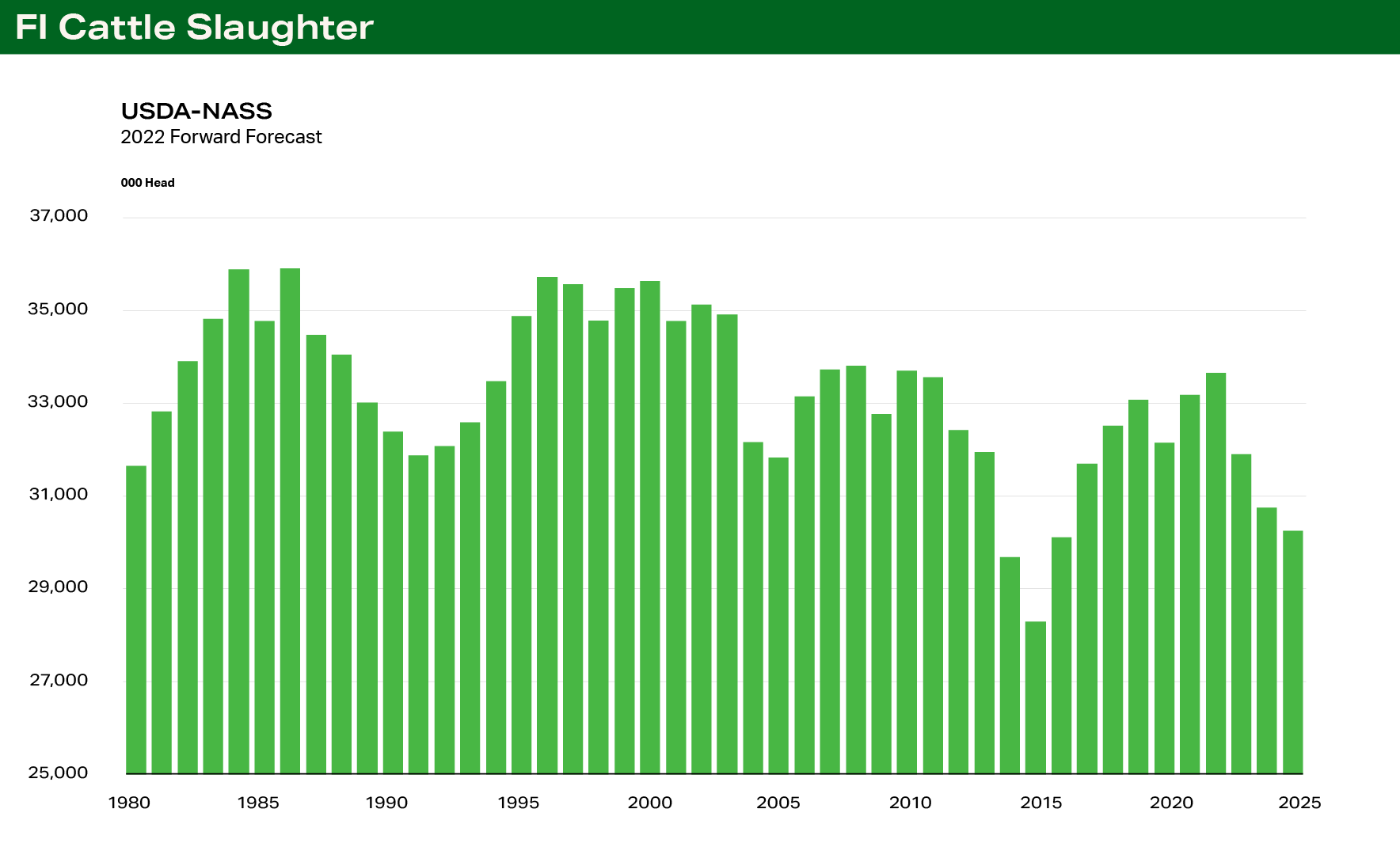

Q1 cattle slaughter down about 6% year-over-year (YOY), resulting in beef production lower by about 7% YOY. 2023 annual cattle slaughter and beef production down 4.5% to 5% versus 2022.

Price Forecast

Fed cattle prices starting 2023 about $10/cwt higher than a year earlier and rallying in March and April to mid-to-upper $160s/cwt which will be the highest 5-area live cattle prices seen since April 2015.

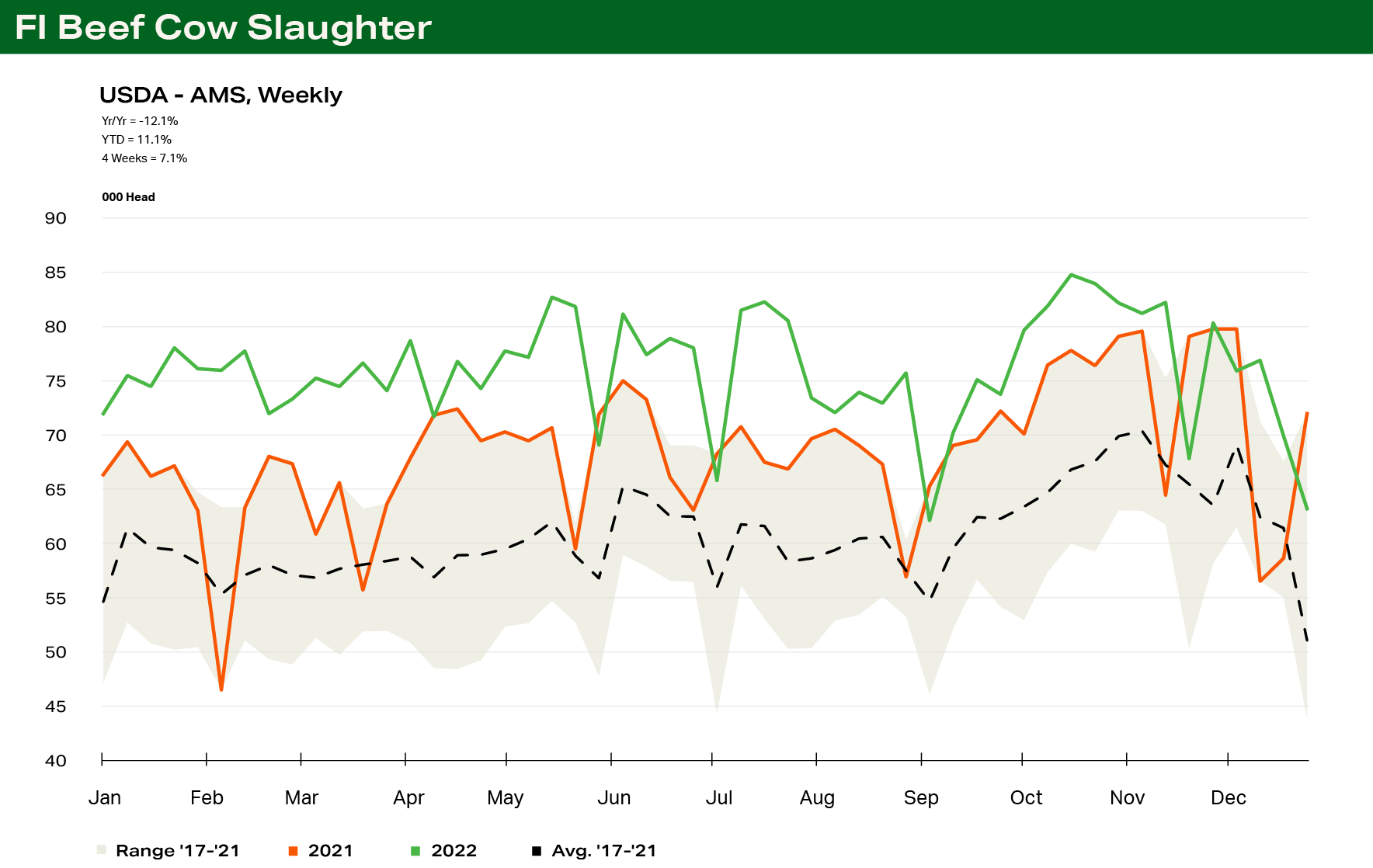

Beef cow slaughter continued at an aggressive liquidation pace during Q4 2022 as drought conditions and high carrying costs continued to diminish producers’ resources and their hope for the drought to break. This left year-to-date cow slaughter up about 11% versus a year earlier. The liquidation pace was the largest culling percentage (slaughter vs beef cow inventory) since 1984 at about 13.1%.

Drought conditions across much of the Central Plains and Southwest have also limited the number of heifer calves retained at the ranch level for beef replacements. I expect beef replacement heifer numbers as of January 1, 2023 to be down nearly 5%, or 275,000 head, versus a year earlier and the smallest total since 2012.

Improving moisture conditions will be required to stem the tide of liquidation. Recent forecast models are beginning to show moderating sea surface temperatures and a trend toward more neutral La Nina conditions. The first half of 2023 may still be dry and could force more cows to be slaughtered. When additional precipitation arrives, replacement female prices are expected to rally sharply as restocking begins.

The tightening of feeder cattle and calf supplies outside of feedlots will also lead to higher prices for yearling and steer calves. The smaller 2021 and 2022 calf crop totals will add to the bullish sentiment in the market for feedlot replacement cattle. The 2022 calf crop was 2.1 million head smaller than the cycle peak calf crop that occurred in 2018. The pandemic-created backlog of fed cattle combined with the drought-forced movement of cattle into feedlots has delayed and masked the expected cyclical decline in fed cattle slaughter and beef production for nearly two years. The result was cycle-high slaughter totals and record beef production during 2022. The recent year-over-year declines in monthly feedlot placements are early signals for a rapid decline of cattle supplies and beef production during the second half of 2023.

Certainly, the leverage amongst the various segments will shift as will the share of margin each segment can garner. The shift in margin share will move toward the segment creating the greatest constraint in the system. For the next few years that will be the cow-calf producer segment.

Fed cattle slaughter plant shackle availability will become less of a limiting factor as the industry moves thru the first half of 2023. Sharp reductions in packing margins in late 2022 are expected to lead to fewer hours of slaughter plant operations in early 2023 thereby creating headwinds for fed cattle prices. Additionally, seasonally softer demand and stiff competition from the broiler and pork segments in Q1 2023 could pose some potential for downside market risk for the beef cutout and fed cattle prices through March. I expect the largest year-over-year declines in quarterly slaughter and production to occur in the first and fourth quarters of 2023, down 6% and 5% respectively, versus a year earlier.

I expect fed cattle prices to take a setback to near $150/cwt in early January and then rally from mid-to-late February into late-April/early-May reaching into the mid-to-upper $160s/cwt. While I expect a rally in middle meat steak items for Valentine’s Day, it may be muted by continued inflation pressures and interest rates. The more substantial spring rally for the grilling season will likely be driven by tighter fed cattle supplies and much improved cattle feeder leverage.

Depending upon the December-through-February placement patterns, fed cattle prices risk trading down into the mid-$140s/cwt by early Q3 2023. This scenario sets up the fed cattle market to average $155 to $160/cwt on a live basis for 2023. Fed cattle prices are expected to trade in a seasonal and non-herd expansion year-type pattern marked by spring highs, mid-summer lows and higher highs peaking in November (5% to 6.5% above spring highs).

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.