Situation

Avocado demand has seen an incredible boost in the last decade. Most of this increased demand, however, has been fulfilled by a surge in imports. Still, grower prices in California have increased throughout this period and are likely to remain stable, a testament to the avocado’s popularity and the ability of producers in the state to carve out their own niche. The net effect is a stable short- and long-term price outlook for the California avocado industry, albeit with some risks on the horizon.

A Look at the Risks After an Unparalleled Rise

Few other fruit commodities have seen such a rapid rise in demand as avocados have. From 2010 to 2022, per capita demand increased from 4 pounds per American to over 9 pounds, according to the USDA’s Economic Research Service. What was once an add-on for salads just a few decades ago has become a key ingredient on café menus (with help from avocado toast) and a staple for Mexican restaurants and Super Bowl parties. Avocados have benefited from a more adventurous and more health-conscious American consumer.

Few other fruit commodities have seen such a rapid rise in demand as avocados have.

The increase in demand, however, has mostly been satisfied by imports as opposed to higher California production. With the implementation of NAFTA in 1994, the U.S. avocado industry experienced a spike in imports. Whereas imports once were approximately 50 million pounds and came from the Dominican Republic and Chile, they’re now near 3 billion pounds, with about 90% coming from Mexico, per the USDA’s Foreign Agricultural Service.

This competition has made it more challenging for California producers, who now represent the minority of avocados eaten in the U.S. And it will likely only intensify. Total harvested avocado acreage in Mexico is on an upward trajectory, nearly doubling in the last 10 years and standing at roughly 600,000 acres today, according to the U.N.’s Food and Agriculture Organization. That’s compared with approximately 52,000 harvested acres in the U.S.

In addition, whereas imports from Mexico thus far have come from only the state of Michoacán because of pest concerns, this changed when the USDA announced that exports coming from Jalisco would also be permitted to enter the U.S. starting in July 2022. Though it is still unclear how this change might affect the broader market, it presents a risk to California producers’ bottom lines.

Meanwhile, at home, U.S. producers have seen challenges on the production side, with increased costs of production, labor shortages and water constraints. These constraints have reduced harvested acreage from its high of over 86,000 in the 1980s. Though competition has posed a challenge for domestic growers, the production obstacles in California are arguably an even bigger risk to the future of the industry.

Despite the steep competition and challenges at home, California growers have managed to carve out a niche that has maintained strong pricing in two ways.

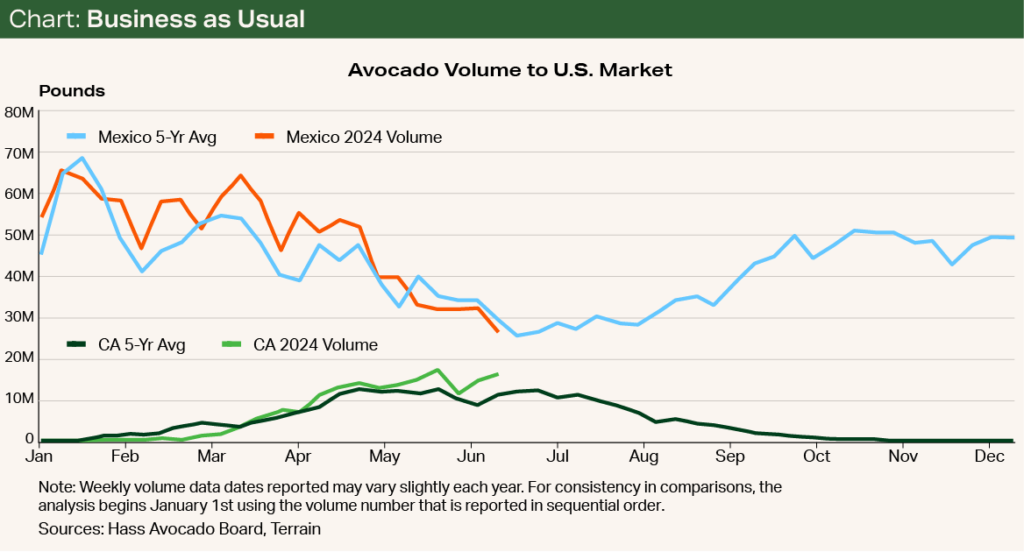

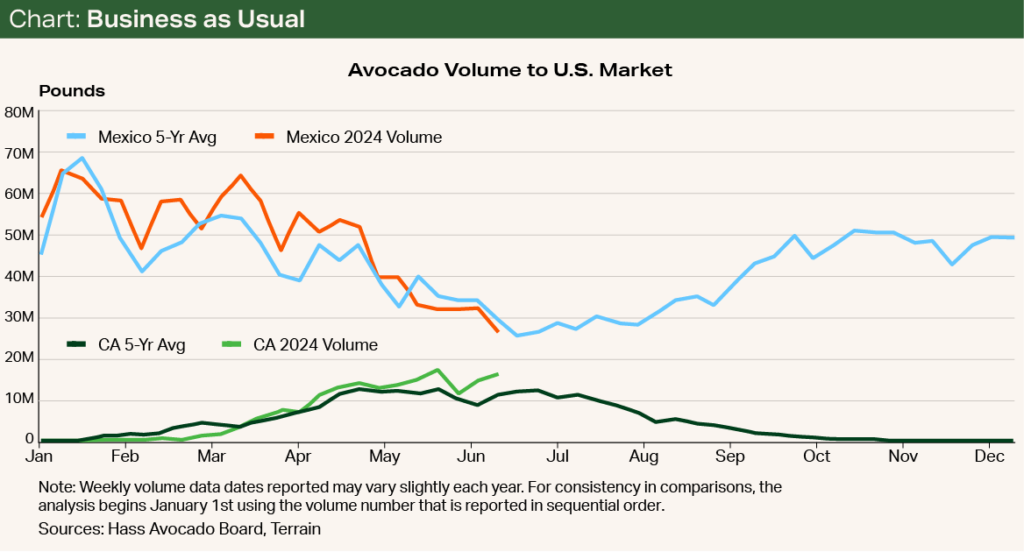

The first is by picking the fruit when Mexico has its lowest volume in April to June (see Chart).

The second is through differentiation. Even with the growth in imports, California producers have benefited from the increase in demand and establishing themselves through high quality. Though consumers noted in a 2023 California Avocado Commission survey that California avocados are more expensive than imported avocados, 63% said that they’re worth the premium.

Despite the challenges facing the California avocado industry, farmers are likely to see stable prices in real terms in the short term.

Outlook

Despite the challenges facing the California avocado industry, farmers are likely to see stable prices in real terms in the short term. The market this year has been roughly in line with the five-year average, with California volumes reaching their maximum while Mexican volumes hit their minimum, as shown in the chart.

One factor that may put upward pressure on pricing in the very near term is the suspension of U.S. inspections of avocados and mangoes coming from Michoacán, which was announced by the U.S. ambassador to Mexico on June 18. Though inspections have gradually resumed since then, this still might be enough to boost the price for some California growers who can fill the market. When avocados from Michoacán were banned for about a week after a similar event in 2022, for instance, avocado prices for some California growers rose rapidly.

Long term, real prices also appear poised for stability, though increasing costs and labor availability could reduce grower margins. While growers may experience downward pressure from the USDA’s Jalisco decision in the medium to long term, avocado demand is showing no signs of slowing.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.