Situation

Robust almond shipments in the 2023/2024 crop year have reduced carryover and bolstered pricing, driven largely by exports while domestic shipments have lagged. A key factor appears to be low consumer sentiment in the U.S. post-pandemic given historic inflation in food prices and consumers trading down in their food-at-home preferences. Despite prospects for continued low sentiment in the short term, easing inflation and interest rate cuts could improve sentiment, boosting domestic shipments for the 2024/2025 crop year.

Background

The almond industry is in a stronger position than it was this time last year. While the 2023/2024 shipment of 2.69 billion pounds didn’t surpass the 2020/2021 record of 2.89 billion, it's the second-highest shipment number ever. Improved shipments have reduced the carryover by about 300 million pounds, bringing inventory levels back to pre-pandemic figures. This more sustainable demand-and-supply balance has raised prices, benefiting an industry that has faced challenges in recent years.

Domestic shipments have increased only 1.6% compared with last year and have been subdued since their peak in 2020/2021.

The improved shipment number is almost entirely a result of a robust export market, which makes up a little over 70% of total shipments. Like the overall shipment picture, exports were the second highest on record at about 1.96 billion pounds, 6.3% higher than last year. The number is especially impressive given the many headwinds facing exports such as tariffs, recessions overseas, and an appreciated dollar (see the last Quarterly Outlook for more on this.)

In contrast, the domestic market has been far less impressive. Domestic shipments have increased only 1.6% compared with last year and have been subdued since their peak in 2020/2021. It’s probable that there is simply limited growth potential in the saturated U.S. market; still, these figures appear low. Domestic shipments this past year, for example, were lower than they were during the 2017/2018 crop year when production hadn’t yet surpassed 2.5 billion pounds, a sure sign that something’s up.

It makes sense that consumers would buy less of a more expensive product at a time when inflation is straining many household budgets.

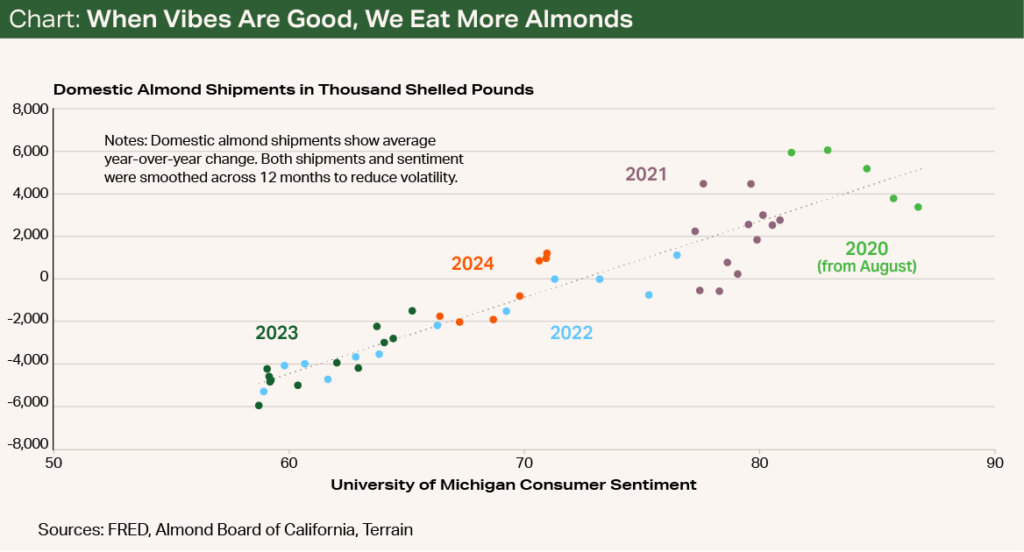

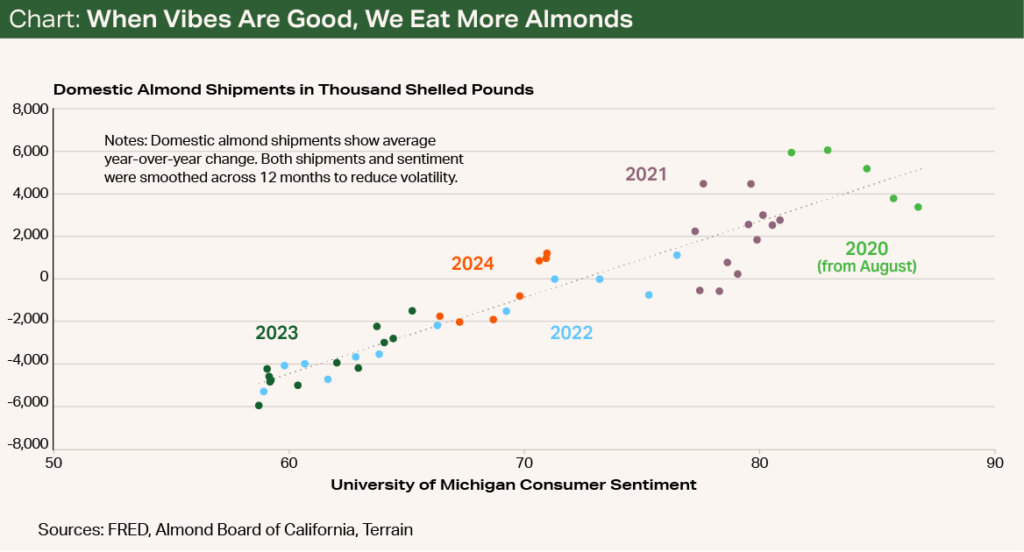

While the explanation is likely multifaceted, negative consumer sentiment in recent years stands out as a key factor. Just as domestic demand has been weak, the University of Michigan Consumer Sentiment Index has stayed low since its sharp decline in 2020. After adjusting for seasonality and volatility, a strong link between the index and domestic shipments in the post-lockdown period is evident (see Chart). Although correlation doesn’t mean causation, it makes sense that consumers would buy less of a more expensive product at a time when inflation is straining many household budgets.

Outlook

Given the apparent link between consumer sentiment and shipments at home, the question of where domestic almond demand might be headed is all about where sentiment will be in coming months.

On the one hand, there is no doubt that the U.S. economy is beginning to slow. Unemployment has continued to tick up and the quit rate has been on the decline, suggesting a softening labor market. Combined with a normalizing personal savings rate and higher debt levels, all this could suggest constant or even worsening consumer sentiment levels.

On the other hand, unemployment remains low in historical terms, real incomes are higher than they were pre-COVID, and inflation has eased. There have also been increases in indicators such as total vehicle sales, which have been linked to increasing consumer sentiment, at least historically. All these factors would explain why we’ve already started to see sentiment tick up a bit since the lows of 2022 and 2023.

Though sentiment may remain low in the near term, it’s likely to improve into late fall and early 2025 as the economy continues to normalize while avoiding a recession.

Consumer sentiment is tricky to predict. Though sentiment may remain low in the near term, it’s likely to improve into late fall and early 2025 as the economy continues to normalize while avoiding a recession. Should better vibes come our way, this could mean more Americans eating almonds and better domestic shipment numbers in the 2024/2025 crop year.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.