It’s likely that the overall return for growers will remain muted this season.

Situation

California strawberry profitability has been challenged this season by a combination of higher costs and low to average pricing. From 2021 to 2024, costs have increased across the board, according to the University of California, Davis. The increases have been accompanied by so-so pricing, which appears to be a consequence of hotter weather, increased volume and subdued demand. The expectation is that prices will rise as we move further into the fall and volumes continue to decline. Still, it’s likely that the overall return for growers will remain muted this season.

Background

In March, UC Davis released a cost study for strawberries, finding that the crop requires about $113,000 per acre to produce (grow, harvest, selling, and all else), an 18% increase from its 2021 study.1 Though this number can differ greatly from grower to grower, most have experienced large cost increases in recent years of some kind. Though cost increases can be found across many categories, increases in labor cost are considerable, particularly given how labor-intensive strawberry growing can be.

What’s made the increases most challenging is that they haven’t been offset by similar increases in revenue. Both studies calculate a negative net return above total costs, assuming a yield of 9,000 9-pound trays per acre. The 2021 return is about -$6,000, assuming a price of about $10 per tray. The 2024 return is about -$14,000, assuming a price of about $11 per tray. Break-even price can be difficult to approximate, but the 2024 study estimates that it hovers around $12 per tray for exceptional yields and around $14 per tray for more typical yields.

Though cost increases can be found across many categories, increases in labor cost are considerable, particularly given how labor-intensive strawberry growing can be.

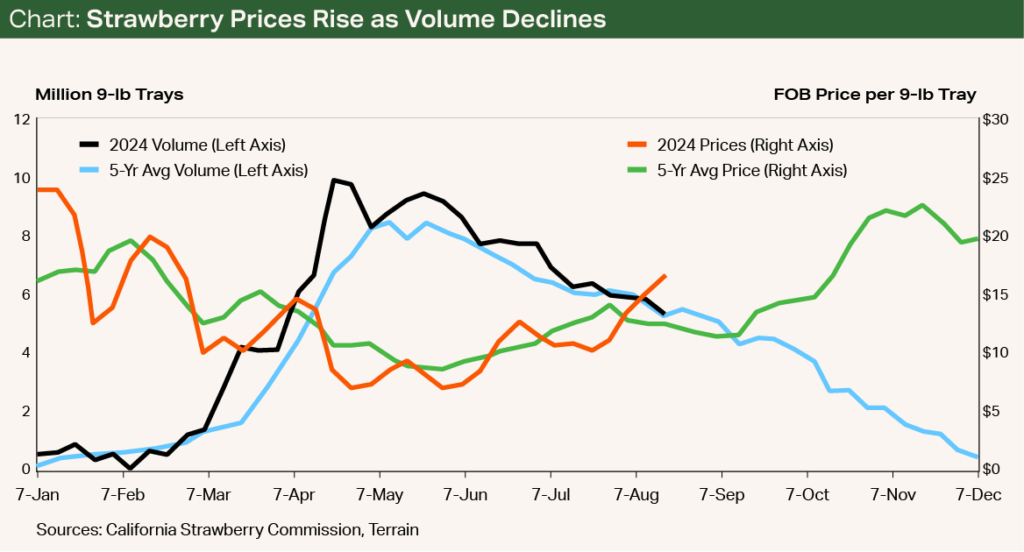

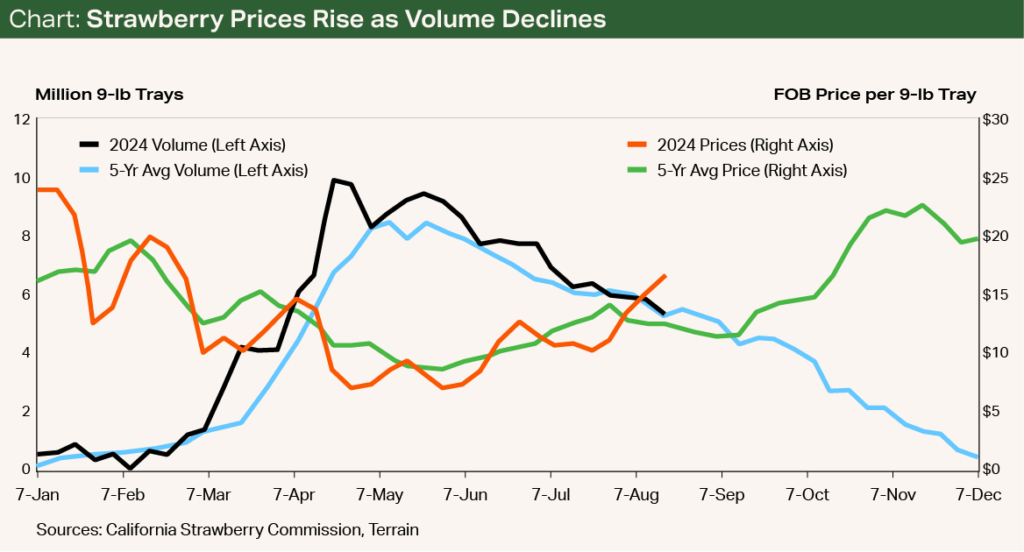

All this brings us to the 2024 season. The year-to-date average price of $13 per tray is roughly in line with the five-year average, according to data from the California Strawberry Commission, and below breakeven for some growers given where yields have been this season. Prices were lower during peak harvest and have been lower for most weeks that prices have been reported, a possible indication that growers were selling a majority of their crop at low to average pricing.

Several factors could explain the soft pricing this season. One might be the reduced quality due to California’s heat wave impacting growers further inland. While coastal areas were cooler, inland regions faced one of the hottest Julys on record, possibly resulting in more bruised berries.

The most persuasive explanation for this season’s soft pricing lies in the expansion of acreage planted in the state.

Another is weaker-than-anticipated demand, particularly during the key spring and summer holidays. Though retail strawberry prices have hardly experienced the inflation surge that many other grocery items have, it’s possible that strawberries are still too expensive for a cost-conscious shopper because they remain one of the more costly produce aisle items.

The most persuasive explanation for this season’s soft pricing lies in the expansion of acreage planted in the state. The California Strawberry Commission's 2024 acreage report reveals total strawberry acreage increased 5% relative to last year, reaching 42,320 acres. Increased acreage leads to higher volumes and lower prices (see Chart).

Looking forward, prices are likely to rise as we move further into the fall and volumes continue to decline as California exits peak season.

Outlook

Looking forward, prices are likely to rise as we move further into the fall and volumes continue to decline as California exits peak season. That said, it’s possible that price increases are less dramatic than in past years for two primary reasons. First, just as total acreage has increased this season, summer-planted acreage for fall production is up 8%, hitting a record 11,209 acres. This will probably keep volumes higher than usual. Second, a hotter-than-typical fall could affect strawberry quality, just as the especially hot July may have earlier in the season.

On a brighter note, strawberry demand is likely to pick up as inflation subsides and the economy continues to normalize. One indication of this is that structural demand growth has shown few signs of slowing down, according to USDA data. In fact, per capita strawberry demand has grown faster than for most other fruits, according to the USDA Fruit and Nuts Yearbook, and it remains one of the best-selling fruits in the produce aisle.

1 Though cost study comparisons can be useful for understanding cost increases, they are not always directly comparable due to different assumptions. While these two studies are roughly comparable, there are discrepancies that should be considered.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.