Still recovering from 2023, the hog industry continues to slowly climb to a place with a better view. Margins are still thin, heightening the industry’s risk of a sudden, dramatic growth in sow numbers, export disruptions, or higher feed prices.

Starting 2025 With Smaller Herd Poised for Profits

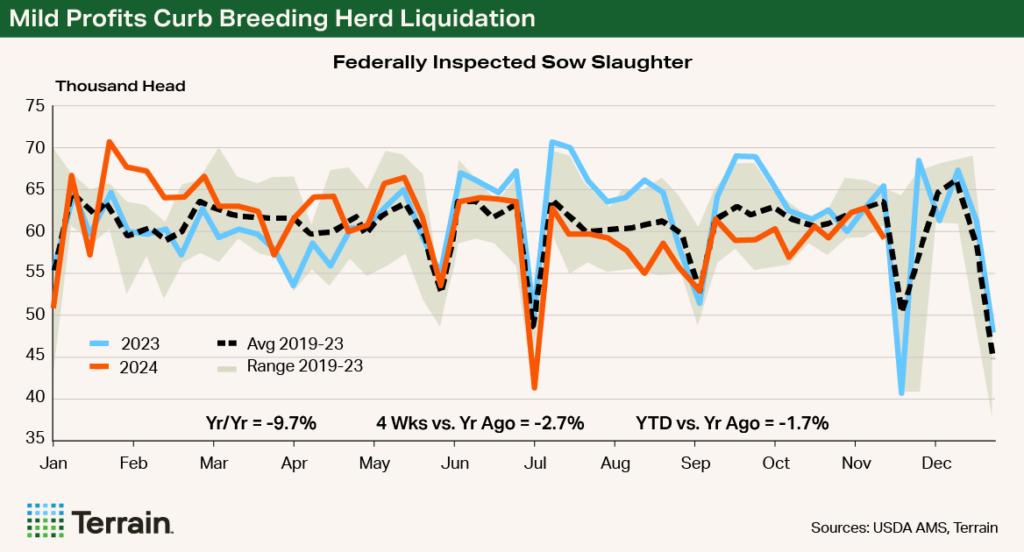

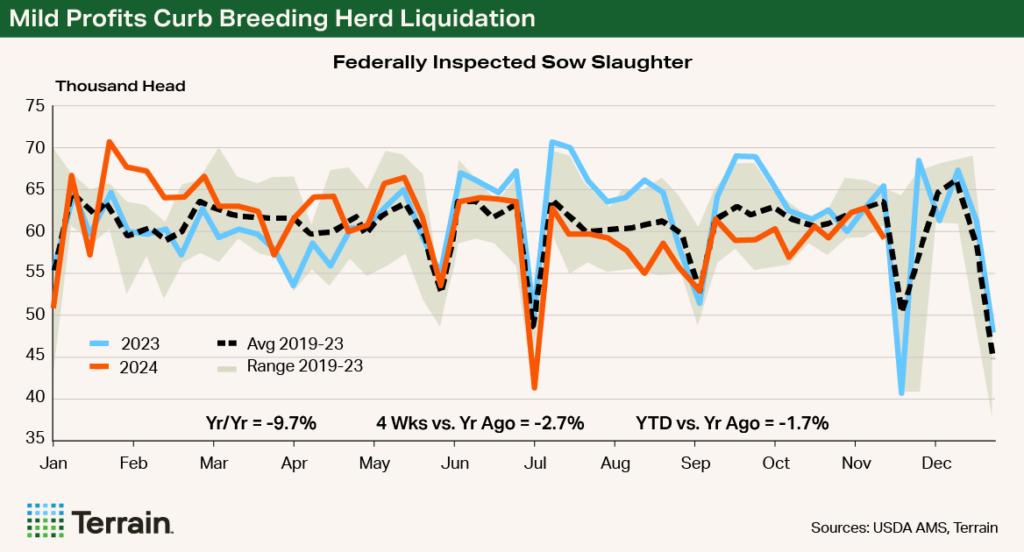

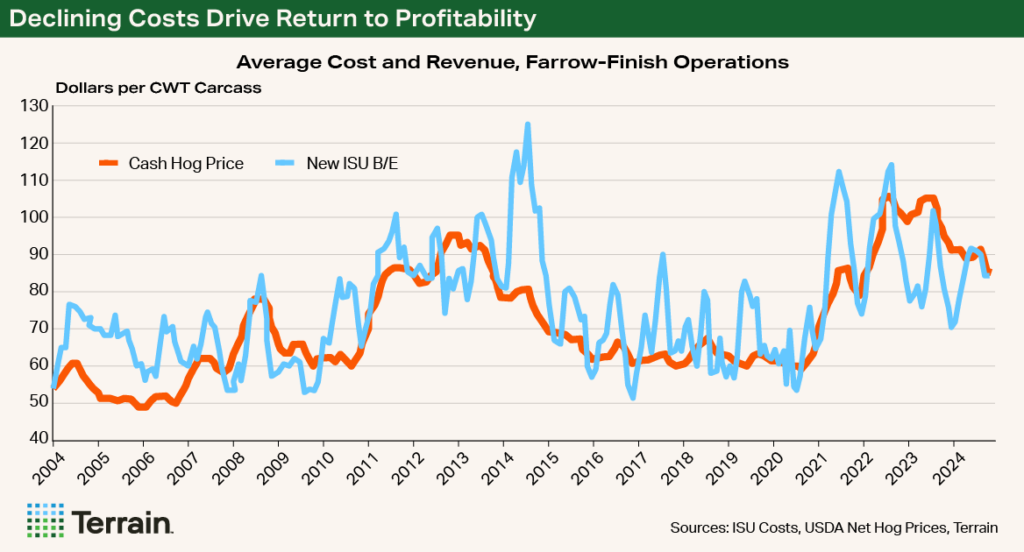

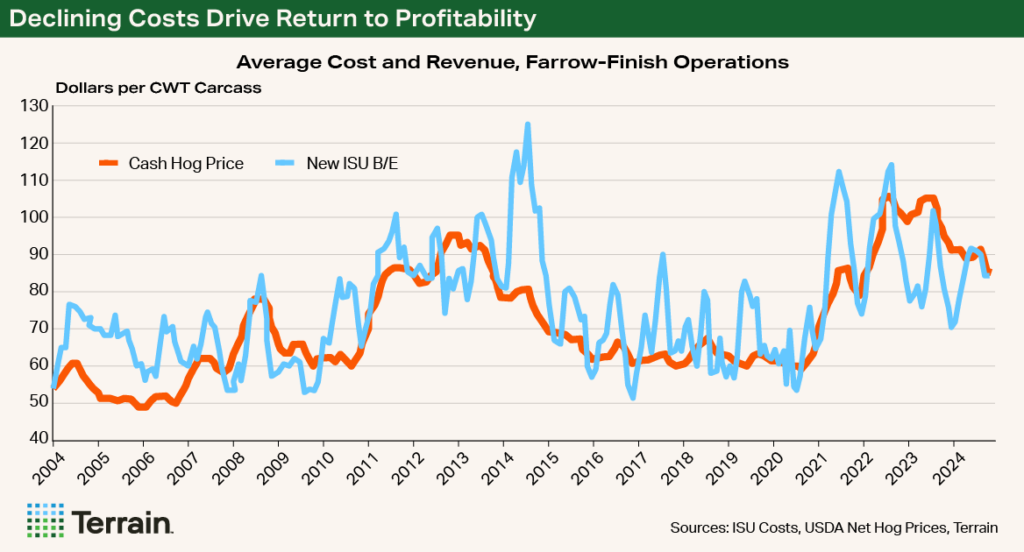

U.S. sow slaughter spent all but a few weeks above year-earlier levels from January through May. In stark contrast, they have been above year-earlier levels for only three weeks since the beginning of June. The positive force of lowering breakevens, as calculated by Iowa State University, since June and a return to profitability from April to October created a modestly bullish price backdrop for producers’ decision-making for female retention.

Sow slaughter as a percentage of the breeding herd spent most of the first half of 2024 above 1%, which is the level needed to reduce the breeding herd. Since early August, slaughter as a percentage of the breeding herd has dropped below 1%, suggesting that additional year-over-year declines in sow numbers are unlikely.

While slaughter levels have declined, they haven’t declined enough to give back all the reductions achieved during the first half of 2024. Sow slaughter from January through the end of November was down about 1.7% versus a year earlier. And from June to November, sow slaughter was down 7.5% (4,800 head per week) versus a year earlier. I expect the breeding herd inventory to be down about 100,000 head in the December 1 USDA Hog and Pigs report set to be released December 23.

Additional profits are expected during November and break-even prices during December. That would likely lead to slight rebuilding or at least a stalling of herd reduction efforts in the first half of 2025.

The sow herd reductions achieved early in 2024 appear to have paid dividends.

The sow herd reductions achieved early in 2024 appear to have paid dividends. Market hog slaughter during September to November was even with year-earlier levels versus our last forecast of 1% to 2% larger. The September 1 USDA Hogs and Pigs report indicated that available supplies of market hogs for September through November were about 4% larger than a year earlier.

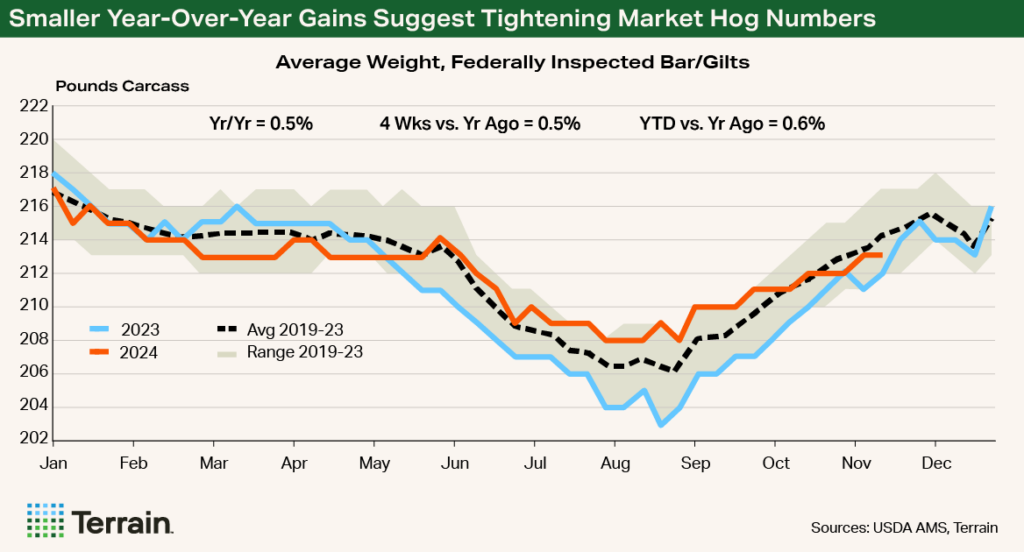

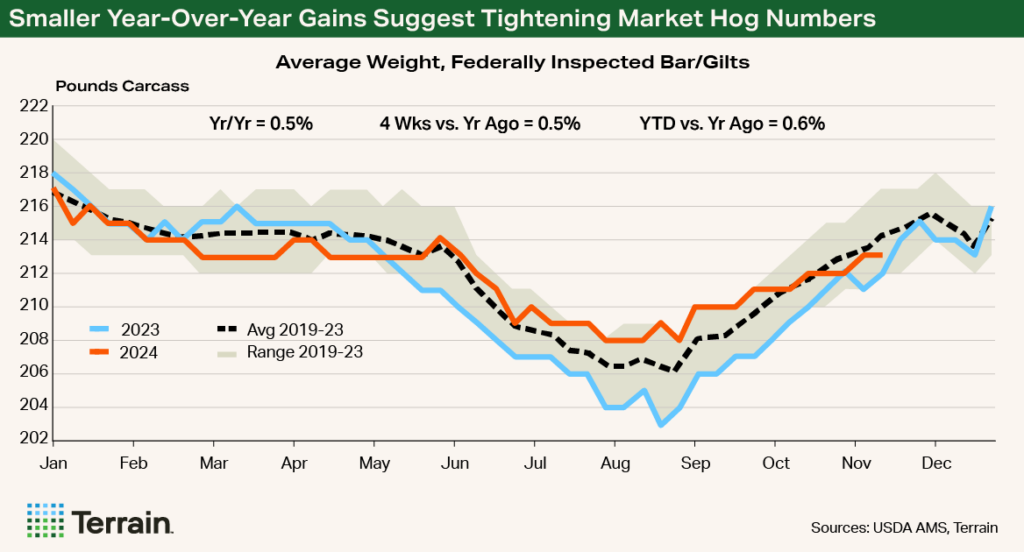

The trend for average weights didn’t keep pace with the normal seasonal trend, suggesting that producers may have overmarketed hogs. This makes sense, as producers were willing sellers, trying to take advantage of the profits the market was offering. But it also suggests we may see downward revisions to breeding herd inventory or pig crop numbers in previously released USDA Hogs and Pigs reports.

My prior worries of the September Hogs and Pigs report underestimating supplies and potentially causing us to overestimate prices and margins appear unfounded. The extra 1% increase in barrow and gilt slaughter for the summer versus the December 2023 to February 2024 pig crop estimate was likely gilts going to slaughter with a positive margin. Those gilts headed to slaughter kept the breeding herd from expanding in the near term. Now I suspect that downward revisions to inventory are likely.

Thin Margins Expose Risk

The nearly 2% smaller-than-expected market hog slaughter totals have kept prices well above our earlier forecast of trading in the low $70s/cwt by the end of the year. Instead, prices appear well supported in the low $80s/cwt.

In Iowa State University’s estimated returns to farrow-to-finish operations, I expect that November data will reveal profits similar to or lower than the previous seven months’ average of $12.77/head. The December data are likely to show a breakeven for the average producer. This would put 2024 average margins at about $3/head.

Since March, feed costs have declined by $11.44/head in the Iowa State data and have accounted for about 90% of the improvement in average margins. These data highlight the margin risk pork producers face if drought conditions return and the offsetting risk to operations that grow a large portion of their feed grain needs.

Current projections for the quarter are for profits in the $7/head to $8/head range.

Q1 2025 Price Forecast Up From a Year Ago

I expect that Q1 2025 prices for producer-sold barrows and gilts will range from near $81/cwt early on to $85/cwt to $87/cwt at quarter’s end. This puts the forecast quarterly average prices for barrows and gilts in a range of $85/cwt to $87/cwt and nearly 10% above the average price achieved during Q1 2024. Current projections for the quarter are for profits in the $7/head to $8/head range.

I project the pork cutout to be seasonally rangebound in the $88/cwt to $90/cwt territory through year’s end and well supported in January through March in the upper $80s/cwt to low $90s/cwt. Three key drivers could cause product to trade outside these bounds, most likely near the bottom of the range: further strengthening of the U.S. dollar hurting trade, an economic downturn in the U.S., or further macroeconomic weakening among our trade partners.

I still don’t expect China to increase purchase volumes of U.S. pork to any large degree over the next several months without some kind of production emergency. If realized, the rhetoric of the incoming U.S. administration and potential additional tariff actions targeting not only China but also key North American markets could further reduce the prospects for sales of U.S. pork abroad.

I expect 2025 market hog prices to average 1.5% to 3% higher than 2024’s, somewhere in the $88/cwt to $89/cwt range. I expect that hog slaughter levels for the year could be near even, down 0.5% to 1.5%, during the first half of 2025 and up 0.5% to 1.5% in the second half. Carcass weights are expected to “normalize” near five-year average levels (omitting 2020 COVID-19 impacts), as lower feed costs incentivize adding more pounds before hogs are marketed.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.