Background: The market has been unkind to sorghum. Crop year to date through February, exports to China are 70% behind the five-year average pace. And while the price of sorghum has fallen considerably, the price ratio to corn remains only borderline attractive to buyers in cattle feeding and bioenergy. As of the March World Supply & Demand Estimates, the USDA reduced exports by another 70 million bushels, now estimated to finish 2024/25 at 100 million bushels.

Sorghum profitability will be challenged in 2025 for three reasons.

That the USDA cut sorghum acres for 2025/26 by 5% at its February Agricultural Outlook Forum should also come as no surprise. Terrain predicted this trend in our prior Quarterly Outlook released in December 2024.

Outlook: The question now is, what are the factors that need to change to make sorghum profitable in 2025? In our opinion, sorghum profitability will be challenged in 2025 for three reasons:

- Cost of production

- Stagnant demand

- Heavy stocks

Cost of Production

The cost of production for sorghum remains onerous. Though only 2% above year-ago levels, the cost of fertilizer, herbicide and seed for sorghum in southwest Kanas has increased 57% since 2016, according to budgets from Kansas State University.

To put this into perspective, at $4/bu. sorghum, the cost of production has increased by 15 bushels while at the same time actual yields in Kansas have remained flat since 1990. This likely puts sorghum cash flow in the red at today’s prices.

Stagnant Demand

Over the last 20 years, more than half of sorghum production has been exported. However, exports for the 2024 crop are currently running 75% lower than last year and 70% behind the five-year average.

Without China, sorghum’s ability to quickly find an export outlet for its building supplies is unlikely.

The primary culprit for diminished exports is China, which has imported only over 40 million bushels, compared with nearly 182 million bushels the same time last year.

The decline in exports to China has an outsize impact on the sorghum market because China has accounted for more than 80% of sorghum exports over the last 10 years. Without China, sorghum’s ability to quickly find an export outlet for its building supplies is unlikely.

At the Agricultural Outlook Forum at the end of February, the USDA estimated sorghum exports would decline 26% in the 2025/26 marketing year from the previous year. However, given the old-crop March revisions, the 2025/26 export forecast is likely overstated and will be reduced in the May report of new-crop estimates.

The decline in price to entice the increase in domestic feeding activity is coming at a steep cost to the farmer.

Additionally, the March USDA forecast for sorghum exports in 2024/25 at 100 million bushels was reduced by another 70 million bushels from the February update and is likely still overstated by nearly 40% compared with Terrain’s forecast. Based on actual export sales activity crop year to date through February, Terrain estimates that full crop year sorghum exports will finish closer to 61 million bushels. This is 7 million bushels lower than the 2018/19 crop year, with further potential downside depending on any ongoing trade disputes with China.

The USDA does not expect domestic demand to completely offset the loss in exports. Although domestic feed use was increased by 50 million bushels, ending stocks will increase another 20 million bushels to account for the lower export forecast. Typically, cash sorghum needs to trade near a 15% to 20% discount to cash corn before large feedlots begin to make the switch in earnest. As of the first week of March, cash sorghum prices in western Kansas were trading between 17% and 19% below cash corn prices, which could begin to entice some feeding activity.

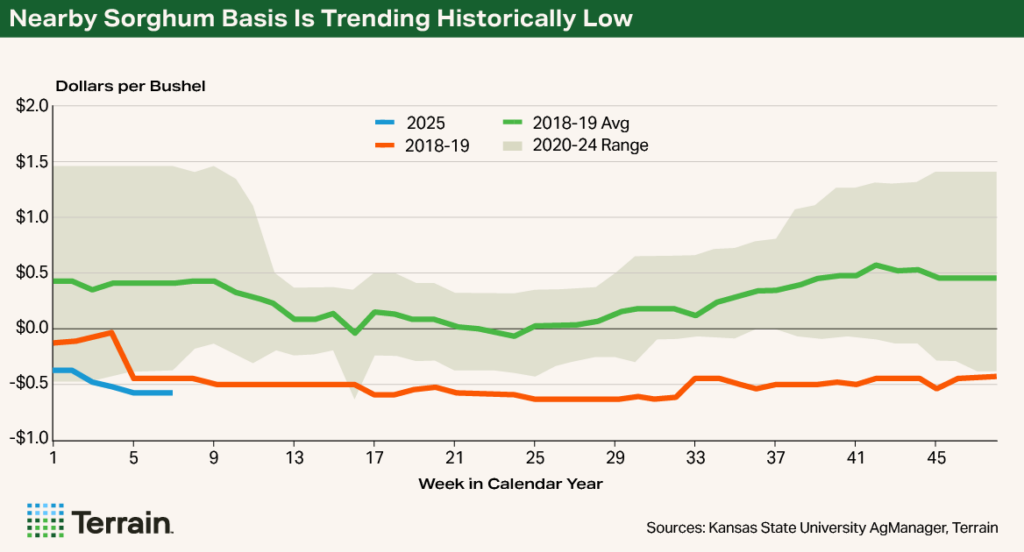

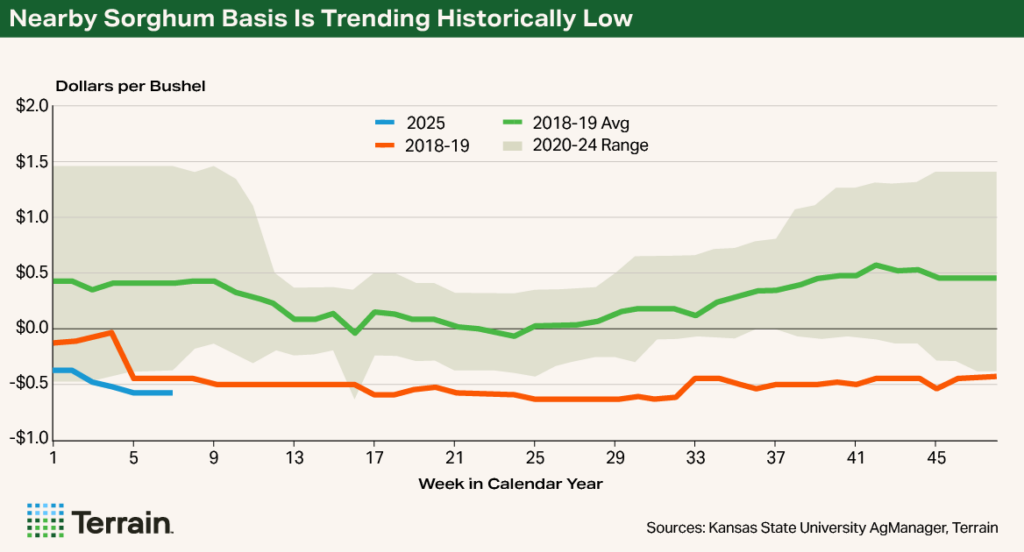

However, the decline in price to entice the increase in domestic feeding activity is coming at a steep cost to the farmer. This is best represented in sorghum basis, or cash difference to nearby corn futures, which is running historically low to drive price down enough for domestic demand to pick up. The current basis for old-crop sorghum is running near the 2018/19 crop year when domestic use was last at, or above, the level the USDA currently expects. As price drives lower to meet demand, the potential farmer profit drives lower as well.

Heavy ending stocks will likely keep a lid on upward potential for sorghum prices and challenge cash flows.

Heavy Stocks

The USDA’s expected 5% decline in acreage production to 6 million acres, assuming average yields, would not outweigh sluggish demand. Ending stocks for the 2025/26 marketing year are expected to reach 40 million bushels, the highest since the 2021/22 marketing year and the third highest in the last 15 years. If demand estimates are revised to reflect the actual export sales pace with China, ending stocks would be revised upward, as they were in the March update from the USDA. Heavy ending stocks will likely keep a lid on upward potential for sorghum prices and challenge cash flows.

Staying vigilant to be ready to price into rallies at profitable levels will be paramount.

Reward the Rallies If They Come

For farmers with sorghum in their normal crop rotation who have unpriced bushels, it is likely going to be a year where the market offers limited opportunities. Staying vigilant to be ready to price into rallies at profitable levels will be paramount.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.