The Big Shrink • April 17, 2025

A Nut Worth Cracking: Assessing Demographic Change for the Nut Market

With around 70% of production exported annually, the U.S. tree nut industry relies heavily on export markets for growth.

Key Takeaways

- Situation: The California tree nut industries have built a strong stable of export customers, but a new risk – population decline – may challenge that demand base in coming decades.

- Outlook: A declining population and relatively greater supply of nuts may increase competition and volatility in global nut markets.

- Impact: Considering that the economic lifespan of an almond or walnut orchard is about 30 years, the projected population peak in 40 years, and aging populations earlier, may influence current planting decisions.

Now is the time for the nut industry to strengthen domestic demand and develop new markets around the world.

With around 70% of production exported annually, the U.S. tree nut industry relies heavily on export markets for growth. The almond, pecan, pistachio and walnut industries have diversified their trade partnerships, which remain financially strong and stable. But future growth could be stunted if there are fewer people in those previously good markets. Even as current and near-term demand continues to thrive, now is the time for the nut industry to strengthen domestic demand and develop new markets around the world.

The Tree Nut Industry Explodes!

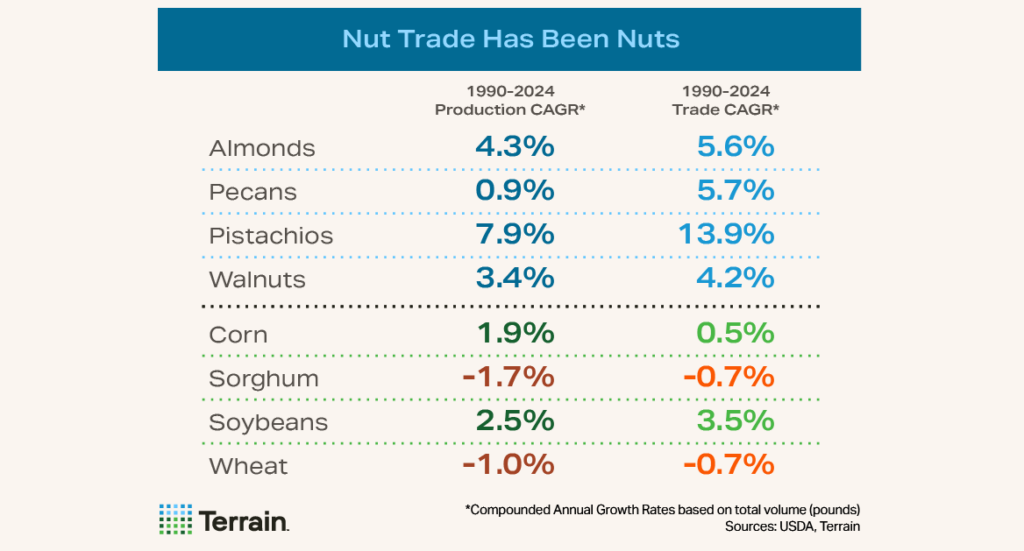

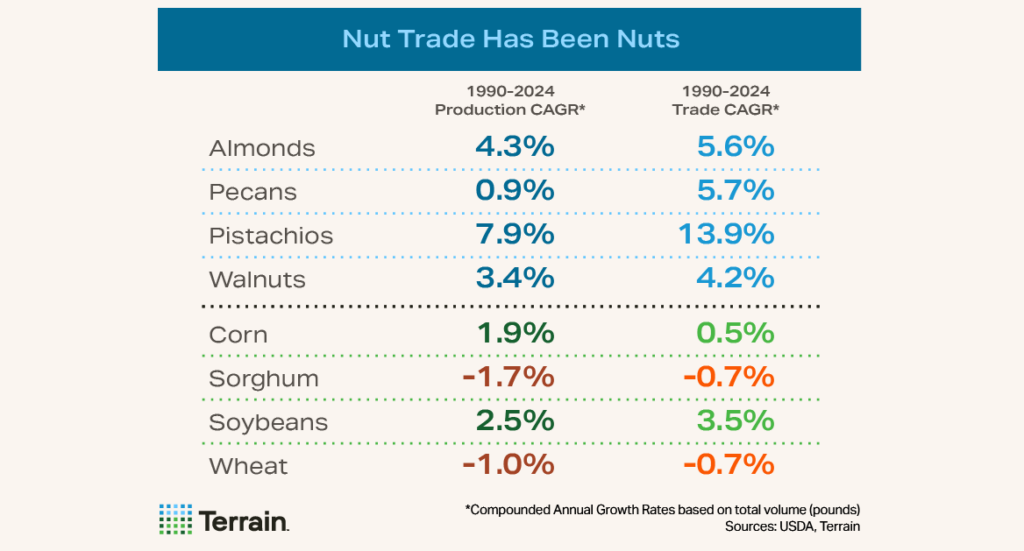

Over the past 30 years, the tree nut industry has expanded significantly in production and trade. From 1990 to 2023, the compounded annual growth rates for almond, pecan, pistachio and walnut production were 4.3%, 0.9%, 7.9% and 3.4%, respectively.

The export market has grown to accommodate this expansion in production, with more than two-thirds of almond and walnut production and about 60% of pistachio and pecan production being exported from 2019 to 2024. In 2023, U.S. almonds, pistachios and walnuts dominated the global export market share, comprising 85%, 70% and 44% of total global exports, respectively. U.S. pecan exports, though with limited data, represented roughly 35% of global exports.1

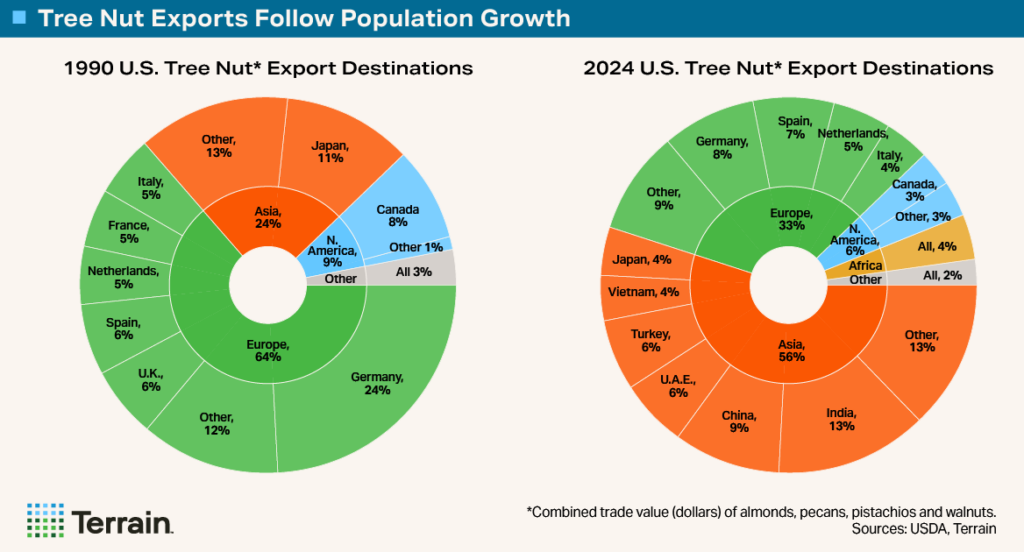

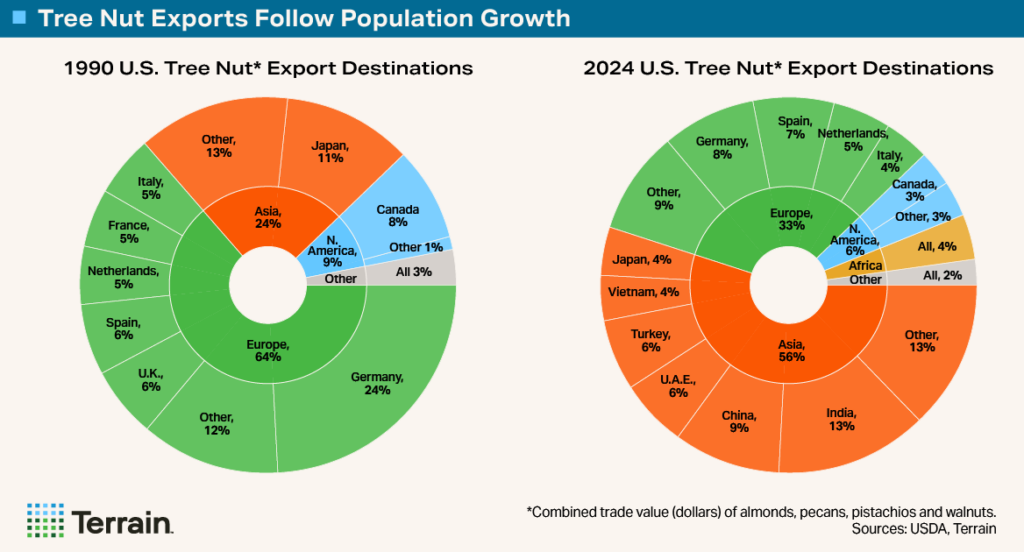

The mix of trade partners for the tree nut industry has shifted drastically to accommodate export demand. Consider, for instance, that in 1990 countries located in Europe accounted for about 64% of total trade dollars of almonds, pecans, pistachios and walnuts, while Asian countries accounted for only 24%.

However, by 2024, Asian countries accounted for 56% of the total trade dollar and Europe accounted for only 33%. During this period the population of Asia grew nearly 50%, compared to less than 3% for Europe.

The Industry Built a Great Rolodex

To support the significant expansion in exports, trade industries, exporters and USDA developed new markets and trade relationships, as well as grew existing ones, resulting in an extensive network of partners around the world. From 1990 to 2024, the number of countries receiving U.S. almonds, walnuts, pistachios and pecans increased 56%, 115%, 177% and 130%, respectively, to 132, 105, 104 and 61 total countries.

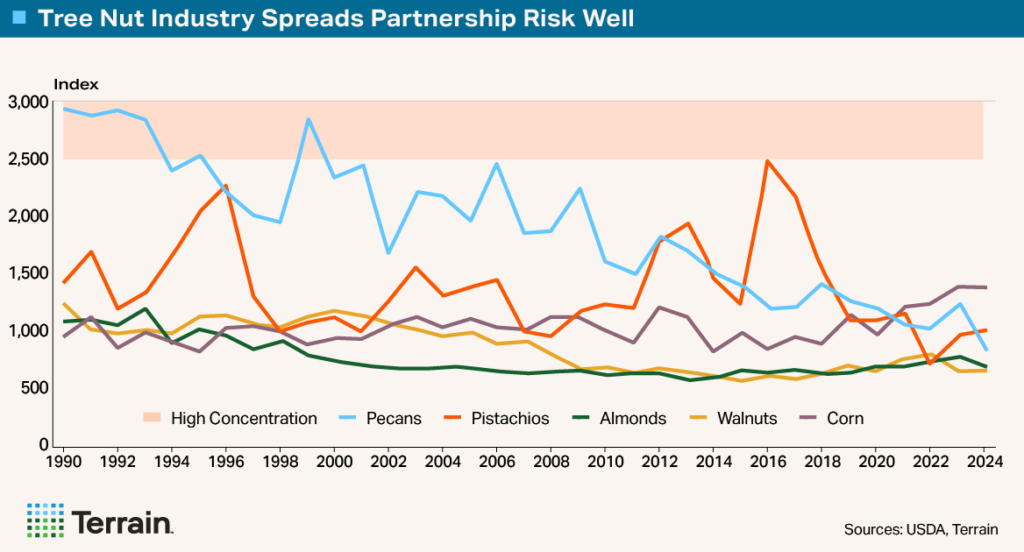

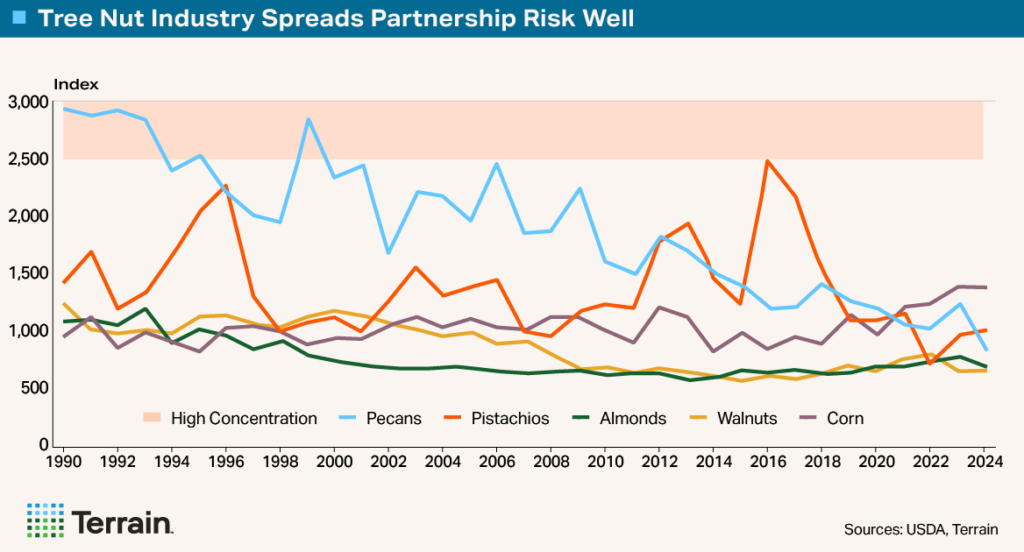

More important than the number of export destinations has been the steady distribution of exports. The Herfindahl-Hirschman Index (HHI) measures market concentration, with scores above 2,500 indicating high concentration. For almonds, pecans and walnuts, the HHI has steadily improved, remaining in the “unconcentrated” region. The concentration of pistachios briefly increased in the mid-2010s, due to large exports to Hong Kong, but has since evened out. A broader distribution of trade partners helps protect the tree nut industry from isolated, country-specific issues (economic troubles, political upheaval, trade policies, etc.).

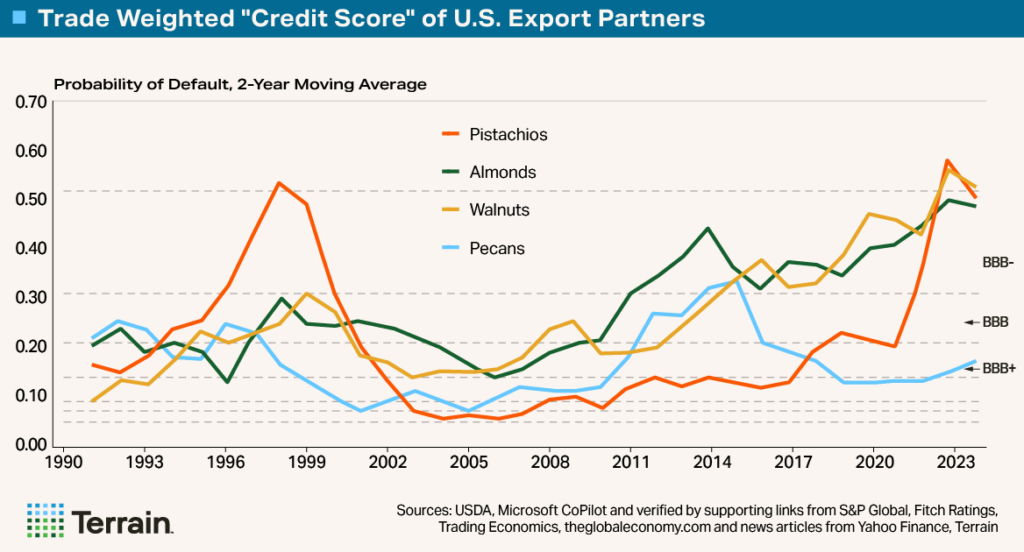

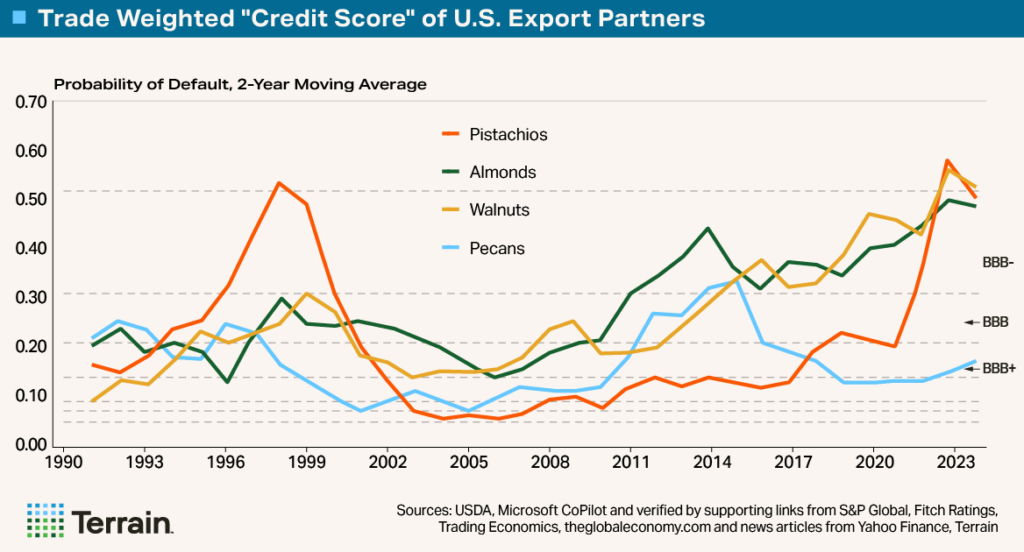

In addition to having a broad mix of trade partners, each of the nut industries also has built a stable of reliably strong, high-quality trade partners.

Sovereign credit ratings measure a country's ability to repay debts, like personal credit ratings. We converted sovereign credit ratings to a numerical probability of default and weighted scores by each country’s export share. A rating of BBB- or better is “investment grade;” below BBB- is “speculative.”

The pecan industry scores very well due to long-term relationships with financially strong countries such Canada, China, Germany, Netherlands, etc. Risk has increased slightly in the almond industry but remains in overall good standing. Pistachios and walnuts also remain in good standing, though risk has climbed due to economic struggles in Turkey, a key export partner.2,3,4

The prospect of global population decline is critical for all of agriculture, but it’s particularly important for nut crops that have relied so heavily on exports to build demand.

But Our Friends Are Shrinking

Despite the tree nut industry's strong Rolodex, a new risk has emerged. Terrain analysis has shown that the global population is likely to peak in as soon as 40 years, which would begin to shrink the consumer base for tree nuts. The prospect of global population decline is critical for all of agriculture, but it’s particularly important for nut crops that have relied so heavily on exports to build demand.

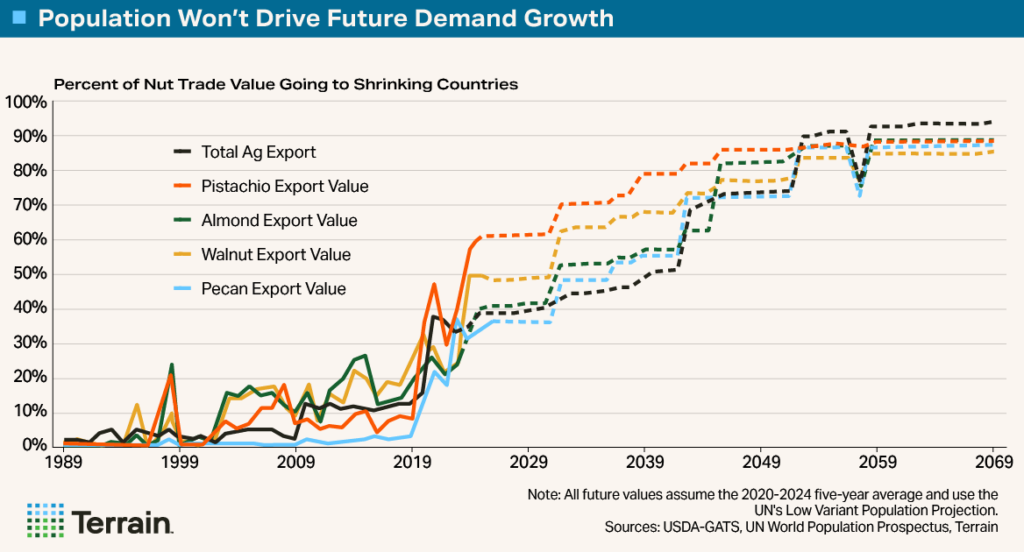

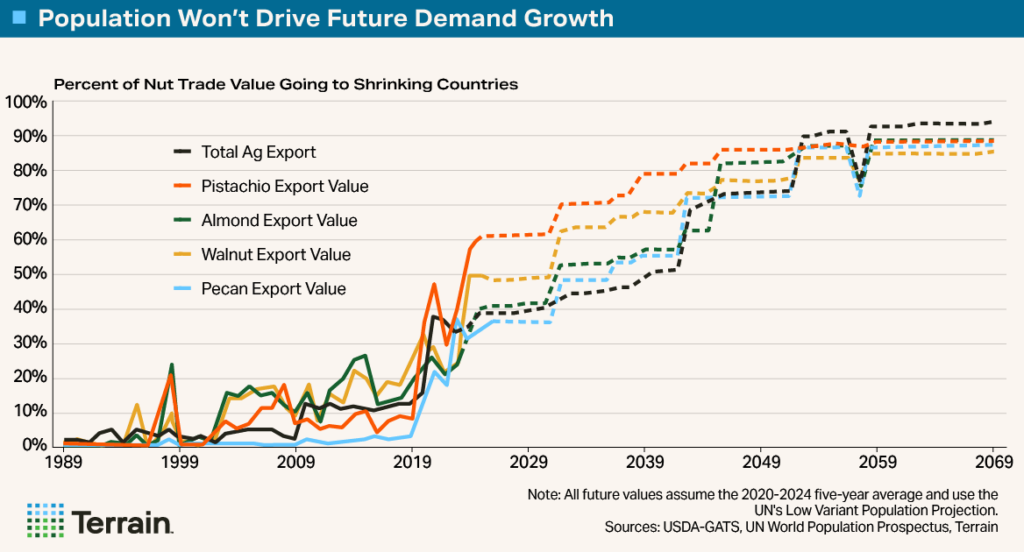

An intuitive way to measure the risk of shrinking populations is to calculate the percentage of export value that is going to countries that are in decline. In the 1990s this risk was nearly nonexistent, with almonds, walnuts, pistachios and pecans each allocating less than 1% of their trade value to countries experiencing population decrease.

Today, more than 75 countries are experiencing population decline, including important trade partners like China, South Korea and Europe. Sizeable portions of tree nut exports now go to countries already in population decline: 33% for almonds, 57% for pistachios, 50% for walnuts and 32% for pecans.

Beyond 2024, we assume trade values remain at current five-year averages and use the U.N.’s country-level low variant estimate for future population growth rates, an estimate we feel is realistic. (You can read more on population estimates in another “The Big Shrink” report, “How Will Agriculture Navigate the Baby Bust?”) Our analysis shows that the tree nut industry soon (by 2030) will be exporting primarily to countries with shrinking populations. By the end of the century, over 90% of the export value for each nut will target declining nations.

Let’s Innovate and Collaborate

The tree nut industries’ building of trade partners is a great success story. The industry has managed to export an impressive amount of its production while maintaining a broad set of trade partners that are both reliable from a credit perspective and trade friendly. Economic conditions thus far have largely provided extra tailwinds in the industry’s favor, with so many new export markets exhibiting income and population growth.

Population, however, is poised to become a headwind rather than a tailwind in the not-so-distant future. Considering that the economic lifespan of an almond or walnut orchard is about 30 years, the projected population peak in 40 years may even impact the decision to plant today.

As we move forward, a declining population may heighten competition and volatility in global nut markets, with relatively greater supply chasing relatively less demand. This trend is arguably already evident in the global walnut market, where China and Chile have emerged as strong competitors to California producers.

Given these possible trade risks, we see two valuable ways these industries could move forward:

- Innovate to build domestic demand

- Continue to develop trade relationships with new markets

Historically, these commodities have been on the frontier of product innovation in agriculture. It’s often joked about almonds, for instance, that they appear in every aisle of the American grocery store, whether it’s the almond oil found in shampoos or the sliced almond found in cereal. But the innovation must continue and even ramp-up where it can among all the tree nut industries and be brought to other countries where populations are also moving toward healthy, protein-packed diets.

The second area of focus is to continue to develop export markets that have a long demand growth runway. Indonesia and Brazil, for example, are both upper middle-income countries with large populations, but they are small export markets relative to total nut imports from the U.S. Though both countries are expected to peak before global peak population, their populations are relatively richer, and they represent large areas that have been mostly untapped for the U.S. industries. And who knows, maybe someday they’ll have almonds, pistachios, walnuts and pecans in every aisle of the grocery store, too.

Endnotes

1 All export data in this article is taken from the USDA-FAS Global Ag Trade System (GATS) database.

2 Data from each country was individually sourced using Microsoft CoPilot and verified by supporting links from S&P Global, Fitch Ratings, Trading Economics, theglobaleconomy.com and news articles from Yahoo Finance. If an S&P Global rating was used when S&P and Fitch did not match, interyear changes were averaged across the calendar year.

3 An example of this conversation process can be found in “Credit Quality of Kansas Farms” by Allen Featherstone and Michael Langemeier, Kansas State University Department of Agricultural Economics, November 2015, http://www.agmanager.info/KFMA/Newsletters/Research/Credit.pdf.

4 The idea for this topic was based on the online article “Letter of Credit Risks in Uncertain Financial Times,” published by Shipping Solutions on March 22, 2009, https://www.shippingsolutions.com/blog/letter-of-credit-risks-in-uncertain-financial-times#:~:text=There%20are%20eight%20country%20risk,with%20changing%20country%20risk%20profiles. Due to historical data availability and conversations with exporters in the U.S., sovereign debt ratings were used over other practices such as the OECD’s Country Risk Assessment Method.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.