Report Snapshot

Situation

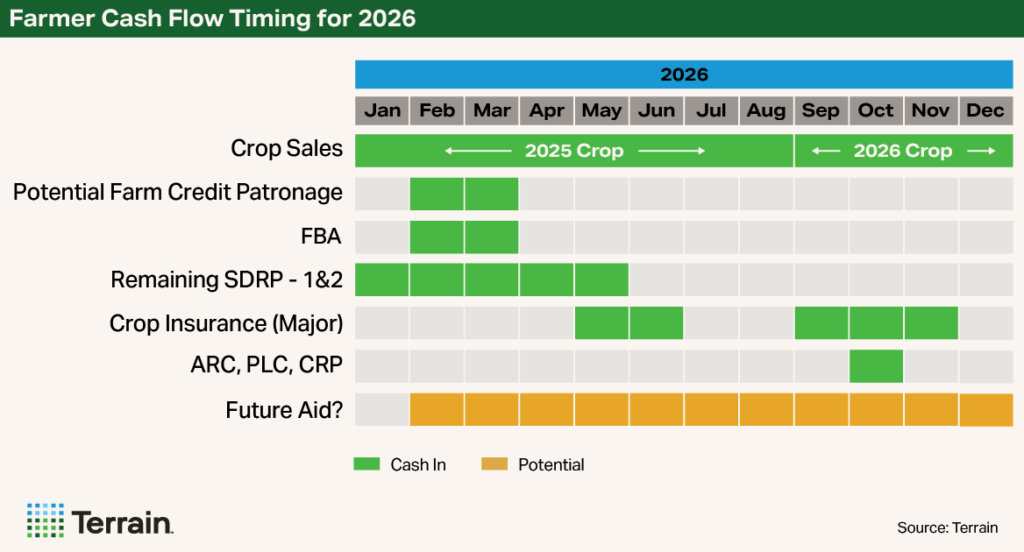

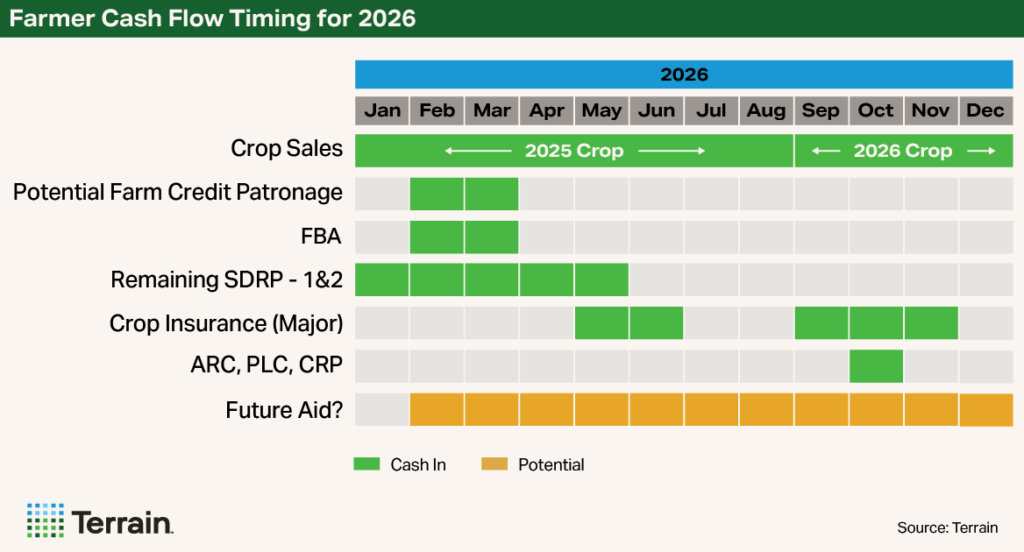

Apart from grain sales, farmers can expect up to four additional periods of cash infusion this year (late winter, early spring, early summer and early fall) as ad hoc government aid and other program payments are issued.

Impact

Because of continued tight margins, cash flow timing will matter perhaps more than usual this year. Paying attention to this year’s upcoming government programs, their rules and payment dates will be important for farmers as they work to manage cash flows for their operation.

In 2026, crop farmers will face another year of tight margins.

In 2026, crop farmers will face another year of tight margins. Cash flows from the 2025 crop are not likely to follow normal seasonal patterns and will be influenced by ad hoc support and other payment windows in the year ahead.

Because of continued tight margins, cash flow will matter perhaps more than usual this year for tax planning, loan repayments, strategic input purchases for the 2026 crop, household spending and other financial planning.

Paying attention to this year’s upcoming government programs, their rules and payment dates will be important for farmers as they work to manage cash flows for their operation. Among the programs slated for 2026:

- Farmer Bridge Assistance (FBA) payments from the 2025 crop

- 2025 area-based crop insurance indemnities

- Stage 2 of the Supplemental Disaster Relief Program (SDRP-2) and the On-Farm Stored Commodity Loss Program from the 2023/24 crops

- Possible 2025 Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC)

- Possible crop insurance payments in the fall

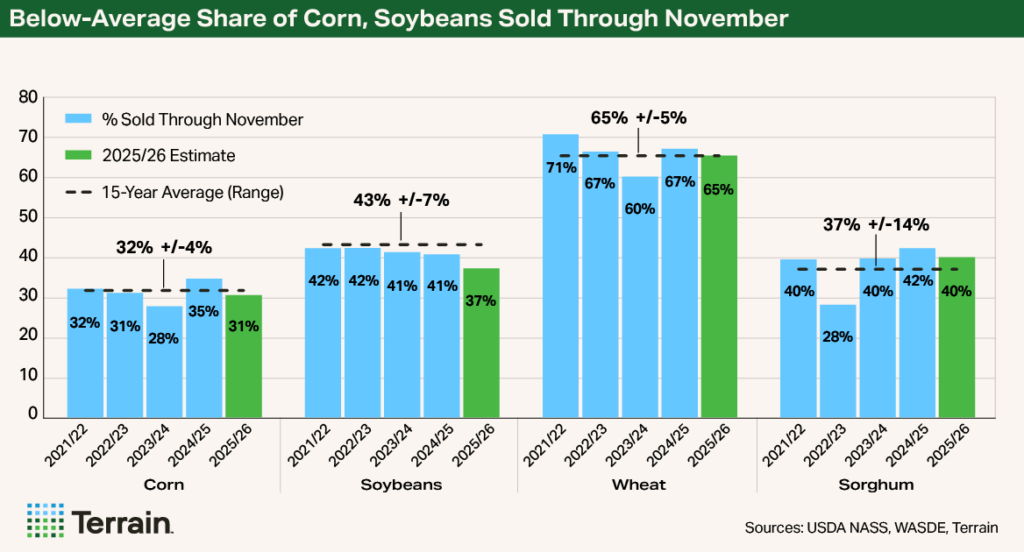

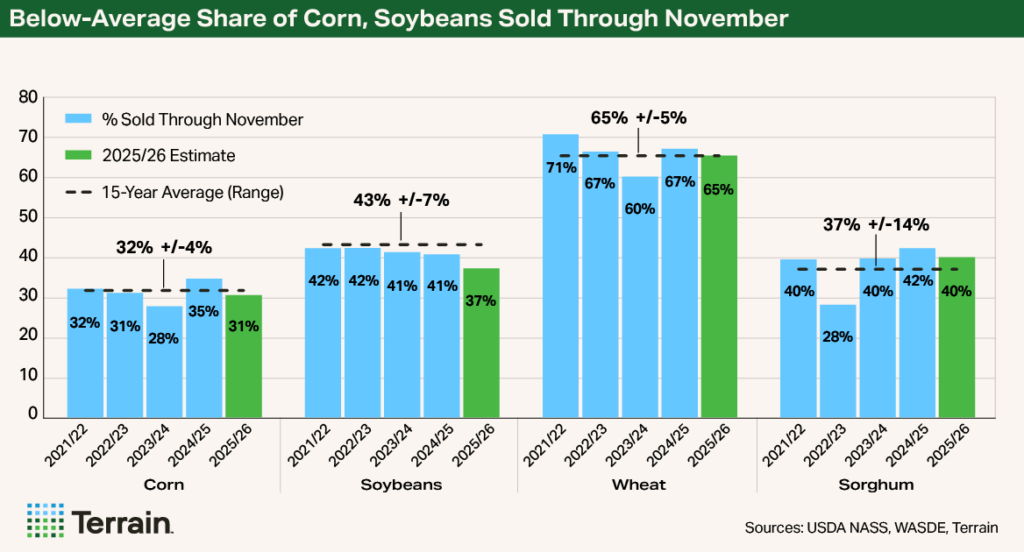

Terrain’s analysis indicates soybean sales lagged normal seasonal patterns early in the marketing year.

Grain Sales From 2025 Crop

Prices for many row crops weakened heading into harvest as expectations for a record crop weighed on markets.

Soybeans in particular were under pressure, with futures prices depressed and basis levels unusually wide across the Northern Plains amid China’s continued absence from the U.S. market. Prices for many producers fell below total cost of production, discouraging sales beyond what was necessary to meet near‑term cash flow needs.

Terrain’s analysis indicates soybean sales lagged normal seasonal patterns early in the marketing year. During the first quarter (September through November), an estimated 37% of the soybean crop was marketed, compared with a more typical pace closer to 43%.

As a result, more soybean bushels are left to market over the remaining three quarters of the marketing year than at any time in the past 15 years. Historically, an average of about 2.78 billion bushels remain unsold after the first quarter. This year, we estimate an additional 5.7% — or approximately 160 million bushels — still needed to be marketed after the first quarter, assuming the ending stocks reported in the USDA’s January World Agricultural Supply and Demand Estimates (WASDE) are accurate.

The situation in corn is even more pronounced. Although the percentage of corn sold is near average, the size of the crop leaves substantially more bushels remaining. Historically, about 10.1 billion bushels of corn have been left to market from December forward. This year, we estimate that figure is about 9% higher, meaning an additional 920 million bushels will need to be sold during the last three quarters of the marketing year.

The combination of slower soybean sales and average sales for a massive corn crop signal that farmers likely began 2026 with significant marketing work left to do.

Carrying Cost Considerations

Now could also be a good time for farmers to assess how their marketing plans and anticipated cash flows interact. The payment for sales of much of the 2025 corn and soybean crops will arrive in 2026 alongside increased government payments. For any grain currently in storage, whether on-farm or in commercial storage, consider how the ongoing carrying cost for those bushels balances with expectations for how markets will evolve — in futures, basis or both — in the months ahead.

With average operating note interest rates near 8%, the cost of carrying grain is higher than it was during the lower‑rate environment of the recent past. On-farm average carrying costs (assuming a nine‑month storage period) could total about 10 cents/bu. per month for corn and about 14 cents/bu. per month for soybeans. These estimates are based in part on Iowa State University’s grain storage cost calculator and incorporate upfront expenses such as drying, handling in and out of storage, transportation, and debt service or return on invested capital averaged over the storage period.

The interest component alone accounts for an estimated 2.5 cents/bu. per month for corn and 6.6 cents/bu. per month for soybeans. Total marginal carrying costs are likely closer to 1 cent/bu. per month higher once additional variable expenses are included, such as labor and the risk associated with maintaining grain quality.

Individual farmers’ costs may be slightly different than these averages. To take a closer look at individual estimated cost of carry, check out the calculator tool from Iowa State University or a similar one adapted by North Dakota State University.

Timeline of Expected Payments in 2026

January-March: Farm Credit customers may also receive income from patronage. Check with your Farm Credit lender for more details.

Late February: FBA payments are expected to land in farmers’ bank accounts shortly after applications are signed with the Farm Service Agency (FSA). This money could be useful for paying down operating lines, paying outstanding input bills, securing last-minute inputs, or rebuilding working capital for the crop ahead.

January-May: Though many of the SDRP payments, either from SDRP-1 or SDRP-2, will have likely gone out by now, the deadline for filing an SDRP-1 or SDRP-2 application is currently April 30. As of January 4, $5.9 billion has been paid out under SDRP-1.

May-June: 2025 area-based crop insurance indemnities are typically paid out, once county yields are finalized by the USDA’s Risk Management Agency.

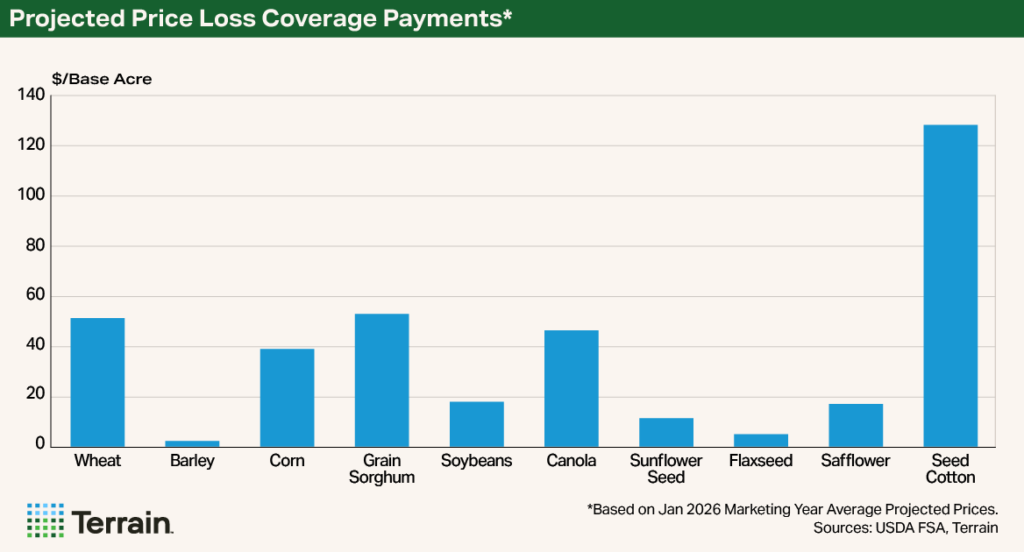

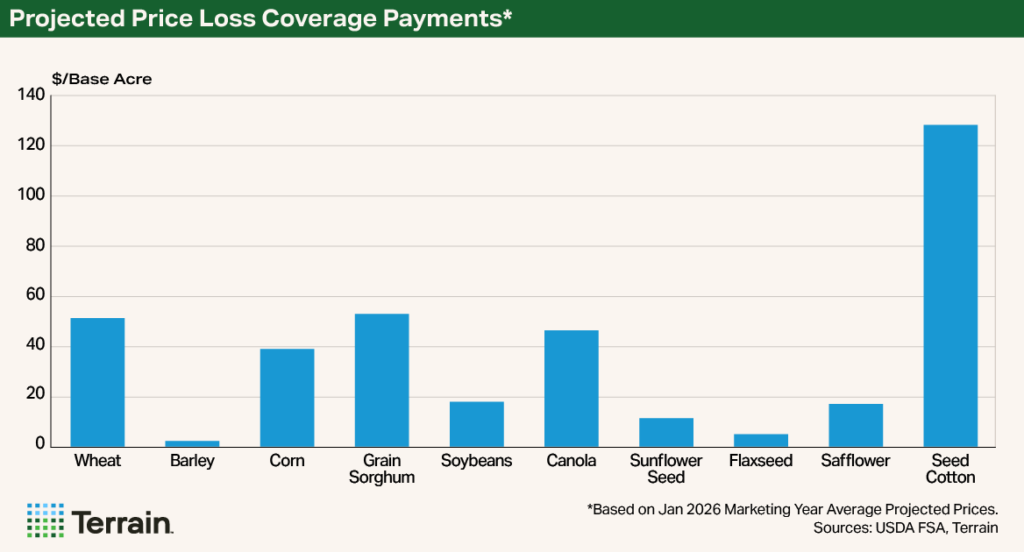

October: For the 2025 program year, farmers will be paid the higher of ARC or PLC as authorized in the One Big Beautiful Bill Act. For the 2026 program year, the decision for ARC or PLC returns to an annual election and includes changes to reference prices, benchmark prices and other program components.

The projected payments shown in the chart are based on the marketing year average prices reported by the USDA in January 2026. Final payment rates, while potentially close to these estimates, almost certainly will be different as marketings and market prices evolve over the remainder of the marketing year for each respective crop.

Payments could be larger than projected in cases where the ARC program pays more than the PLC estimates.

These marketing year average prices will become more certain in the coming months, as will the payment levels.

Additional Aid in 2026?

Before the FBA program details to distribute the allocated $12 billion were even announced, discussions were underway in Congress about the need for additional aid to the farm sector in 2026. For now, we caution to not count on additional aid, but these discussions are worth noting.

Expenses Contribute Also

The revenue side of cash flow projections is not the only factor contributing to overall lumpy flows in 2026. Shifts in the timing of expenses in late 2025 and 2026 matter also. Fewer prepaid expenses at the end of 2025 and more purchases in 2026 can shift the timing needs of cash this year compared with other years, putting additional pressure on cash flows in certain months. This underscores the importance of cash flow planning.

Managing Margins and Cash Flows

Now is a good time for farmers to prepare budget and cash flow projections, if not already done so. These are important financial planning tools for informed decision-making on a range of operational decisions, from marketing to purchase planning, and can help efforts to control overall costs.

If you have these projections and still have questions on where changes need to be made to return to breakeven or profitability, consider outside help from your Farm Credit lender, a trusted advisor, or other specialized consultants.

Last, remaining conscious of family living expenses or withdrawals in times of tighter margins is critical, as more bushels are needed to cover any level of living expenses at tighter margins.

Final Takeaways for 2026 Planning

Apart from grain sales, farmers can expect up to four additional periods of cash infusion this year:

- Late winter: FBA payment lands in bank accounts (target of February 28).

- Early spring: Small infusions of cash from any remaining SDRP applications that were submitted near the deadline.

- Early summer: Area-based crop insurance indemnities are paid out, if triggered.

- Early fall: ARC, PLC and Conservation Reserve Program payments are paid out.

Mapping out projected income and expense dates with your Farm Credit lender can bring additional clarity to your financial picture should unexpected expenses or opportunities arise.

Planning these in advance can help farmers have more productive conversations with their Farm Credit lender, provide better visibility into anticipated cash flows for the year ahead, and help inform crop sales and purchasing strategies for this past harvest and next.

Mapping out projected income and expense dates with your Farm Credit lender can bring additional clarity to your financial picture should unexpected expenses or opportunities arise. It’s also important to communicate with your Farm Credit lender, tax advisor and accountant about accrual adjustments and tax planning to avoid confusion at the end of 2026.

Terrain content is an exclusive offering of AgCountry Farm Credit Services,

American AgCredit, Farm Credit Services of America and Frontier Farm Credit.